Analysis Snapshot: Cairn Homes Primed for Continued Growth

In Cairn Homes’ (Cairn) original prospectus (written in 2015), the group outlined that its strategy was “to capitalise on the recovery of the Irish residential property market by establishing itself over the medium-term as a leading Irish housebuilder, constructing high-quality new homes with an emphasis on innovation, design, and customer service.”

At the time, management correctly identified that there was an accumulation of suitable available land owned by either NAMA or financial institutions, both keen to get it off their balance sheets. They saw an opportunity to acquire a low-cost landbank with the aim of delivering homes to regions starved of housing supply.

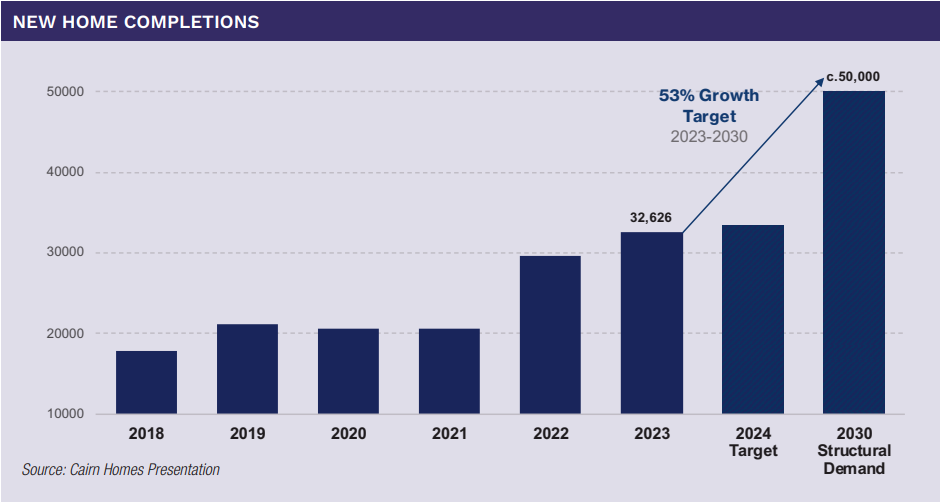

Almost ten years later, now the nation’s largest homebuilder delivering record numbers of homes year after year, it is fair to say management’s execution of its original strategy has been exemplary. Looking forward, the company sits with its largest-ever forward order book valued in excess of €1bn and operates in a country where the housing stock remains significantly structurally undersupplied. Thus, the company’s attractive growth path is likely to endure, and it is not too late for investors to take part.

The Irish Government, via the receipt of significant corporation tax windfalls, is expected to generate a cumulative budget surplus of almost €40bn from 2024 to 2027. As such, it appears inevitable, given the housing crisis is a key policy issue for parties across the political spectrum, that increased state funding will be allocated towards increasing housing output in the years to come. Cairn is ideally positioned, due to its expertise and scale efficiency advantages, to partner with government bodies on state-funded infrastructure projects.

Not least of these is Cairn’s involvement in the development of Dublin’s new town, Clonburris. This infrastructure project is backed by a €186m investment from the Urban Regeneration Development Fund and €19m from the National Transport Authority. The town, located in west Dublin between Lucan and Clondalkin, is set to house approximately 25,000 residents in 8,700 mixed tenure homes. Cairn is contracted to build 5,500 of these units over the next few years, which provides additional certainty over the company’s near-to-medium term income streams.

Importantly, Cairn appears to be reaping the rewards of economies of scale. According to the company, its delivery timeline for apartments “beats the broader market by at least 15%.” Management has also previously highlighted to us that its multi-year pipeline of predictable revenues makes it an attractive proposition for suppliers to tailor their offerings to suit its requirements. The company employs an innovation team to work directly with suppliers and other stakeholders to ensure the sustainability of these scale benefits. Importantly, this is translating into higher margins for Cairn. Last year, the company reported an operating margin of 17%, which was 131bps ahead of its peak pre-COVID. This is forecast to pull back modestly over the next couple of years but remain above historical levels.

Cairn recently issued a trading update for the first half of the year, which confirmed that its impressive operational performance had continued into the summer months. Within the statement, management highlighted the “exceptional demand” for its homes, supported by low unemployment, population growth, an improving mortgage market and “impactful Government initiatives.” The homebuilder experienced a very positive spring sales season, with first time buyers noted as particularly strong, which brings its order book to 3,100 (+300 since May), which has a net sales value of €1.2bn. Management also noted the significant re-investment towards the company’s future growth prospects, resulting in 10 additional site commencements in 2024.

Despite consistent execution by management, the favourable structural dynamics supporting earnings growth, and the company’s unrivalled low-cost landbank, Cairn is still valued at a discount relative to 10-year average UK homebuilder multiples. In our view, the stock can justifiably trade at a premium to these levels, as is implied in our price target which at the time of writing is €2. Management has also previously signalled to us that this is its approximate target for its share repurchase programmes.

Our investment case for Cairn is centred around the significant opportunity it has as the largest homebuilder in the structurally undersupplied Irish housing market. As the company monetises its low-cost land bank of over 16,000 units, it should generate sizeable sums of surplus cash. Management’s intention is to return 2/3rds of this cash flow to shareholders, with the balance to be reinvested back into the business with a focus on strategic acquisitions of planning-ready land with a minimum IRR of 15%. We believe this capital allocation strategy will continue to generate compelling returns for investors.

John Blake

John Blake