Inflation, Growth and Policy Support Positive Outlook for 2024

The beginning of 2024 and developed equity markets are at or near their all-time highs. Economies are at full employment with workers now beginning to see real wage growth as inflation subsides quicker than recent wage rises. That this has been achieved against a backdrop of 2 years of unprecedented rate-hikes and in spite of the most distressing geopolitical events in the last half century should give investors cause for comfort. That it has been achieved ahead of an impending rate-cutting cycle should give investors cause for optimism. The news cycle for 2024 will undoubtedly be filled with the challenges of the upcoming political cycle in the US, the UK and perhaps even closer to home but for markets the monetary policy cycle will ultimately trump the political theatre. Investment into cyclical parts of the economy that have been lagging over the last 2 years will reaccelerate. The momentum in the structural growth areas of economies, namely digitalisation and decarbonisation will be at least sustained and potentially even turbocharged. CFAM enters into the year with their Multi-Asset funds fully invested with positioning in equities split between these two aforementioned themes, the digitalisation leaders of last year but also heavily exposed to the deep value on offer in cyclical sectors which offer compelling valuations.

The irony of 2023 has been that inflation in the west proved, somewhat belatedly, to be transitory. The supply and demand imbalances post-Covid and the Putin-led energy price shock have all subsided quicker than the lags in monetary policy impacted to slow the economy. Economic theory stated you couldn’t get inflation down without an interest rate hiking cycle to bring about a recession. This has proven to be completely incorrect. Inflation over the last 6 months of this year has normalised despite their being full employment, a strong economy, and a stable consumer. Central bankers have acknowledged this recently leading the market to price in “adjustment” cuts beginning late Spring or early Summer. It is counter-factual to argue whether inflation would have subsided so quickly if the Fed or ECB hadn’t hiked to 5%, but given the rate is going to stay there for a such a short space of time, we will never know. The reality entering 2024 is given the outlook for inflation now rates across the western economies are too high and will come down both this year and next. This has the added benefit of removing one longer-term concern around the ability of the US to finance itself at higher rates given the level of debt it currently has.

Positive implications abound for global markets resulting from an inflation-led peak in interest rates. The once-vaunted “Fed put” is back. Every economic slowdown or external crisis can be met over the next number of years with rate cuts. 5% is a very high starting point to cut from. This leaves central bankers with the best tool kit for managing the economy they have had in their history when one also considers their clever use of their balance sheet to deal with issues such as Silicon Valley bank failure and the LDV liquidity event in the UK whilst they were raising rates. Expect risk appetite amongst riskier investors to reflect this safety net of future central bank support.

For lower-risk investors the outlook is improved for two reasons. Rates are peaking, but not collapsing, which gives people ample time to move savings out of low-yielding bank deposits into the higher risk-free rates on offer in other products like our own Cash Fund or lower risk Multi-Asset 30 Fund. Of even greater significance, as rates fall, bond prices will rally, stemming and reversing the mark to market losses a lot of low-risk investors with sovereign bond holdings have suffered as a result of the rate hikes over the last two years.

The strong dollar, with all its negative implications for certain emerging markets and commodities could also have seen its peak for now. Our funds are generally underweight dollars entering into 2024. Another factor to weigh on the dollar will be the political uncertainty around the US presidential election cycle. The Republican primaries begin in January. The leading candidate to win the Republican nomination has little legislative agenda beyond enforcing a global 10% import tax to pay for his previous tax cuts. Former President Trump appears to be running on a personal agenda. As difficult as that will be for markets to price in some risk premium, it is dwarfed in comparison to the challenge markets may have to come to in the summer when it faces the prospect of a Republican convention to select their nominee coinciding with that nominee potentially beginning his trial in Georgia for alleged conspiracy to subvert the 2020 election. Whatever the outcome of the election, fiscal support from the new administration will be under review given the excessive levels of borrowing undertaken since Covid. The strong trend of deglobalisation which has resulted in a non-residential capex boom in the US, however, will remain largely unaffected regardless of the winner.

The performance mix of the equity market should reflect the changing backdrop it faces in 2024 and the positioning in our funds reflects this. Technology stocks, driven by the start of an AI investment cycle, led for 2023 and the outlook continues to look bright for them. Also of interest are the sectors that struggled so much over the last two years. Bank share prices, where fear of recession superseded the benefits of higher rates and commercial real estate, were impending refinancing cycles and high occupancy levels kept investors on the sidelines could offer the type of value longer-term investors are interested in. Decarbonisation investments, which given their leverage and long-life nature, had suffered disproportionately from the combined effects of rate hikes and supply chain snarls should also stage a revival. The reversal of these two factors should jumpstart underperforming sustainable and positive impact investments.

2024 will pose predictably unpredictable challenges for markets and the global economy. Geopolitical events will dominate the news cycle, but as even the most recent evidence has shown, their impact on markets is multi-faceted and somewhat counterintuitive. The combination however of long-term structural investment themes and shorter-term value opportunities allied with the support of a solid economy and favourable central bank policy provide one of the better backdrops for investors entering a new year than they have had for a long time.

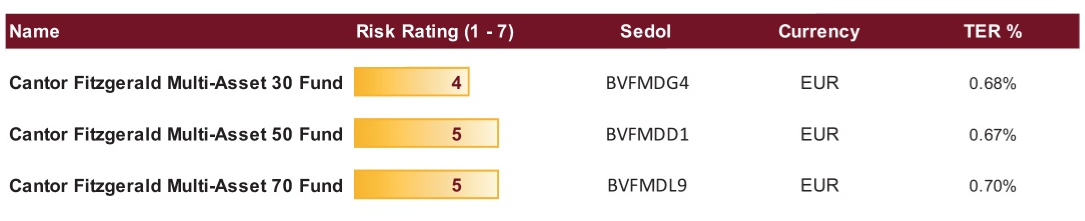

Cantor Fitzgerald Asset Management Core Funds

Cantor Fitzgerald Asset Management Multi-Asset Fund Performance

*Annualised Gross Returns. Source: CFAM 31/12/2023

Philip Byrne

Philip Byrne