What is a Fund?

A fund is a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. The money collected from the investors is managed by a professional fund manager, who makes investment decisions on behalf of the fund’s investors.

Funds are designed to provide investors with a convenient and affordable way to invest in a diversified portfolio of assets. They offer several benefits, including:

- Diversification: Funds invest in a diversified portfolio of assets, which can help to reduce risk and volatility.

- Professional Management: Funds are managed by professional fund managers who have expertise in selecting and managing investments.

- Liquidity: Funds are generally considered to be liquid investments, meaning that investors can buy and sell shares on a daily basis.

However, it’s important to note that funds have associated costs, including management fees, which can vary depending on the fund’s size and investment strategy.

Depending on where a fund is domiciled, a fund may have to be accompanied by a KIID (Key Investor Information Document) Under the European directive 2009/65 EC (“the Directive”), from 1 July 2012 Investment managers will be required to issue Key Investor Information Documents (“KIIDs”) for all Funds marketed to retail investors. The KIID provides summary information in relation to the Fund to assist investors in deciding whether to make an investment or not. The same is not required in the USA or Asia, however some sponsors may choose to produce one for marketing reasons.

Risk & Return: Funds

Risk

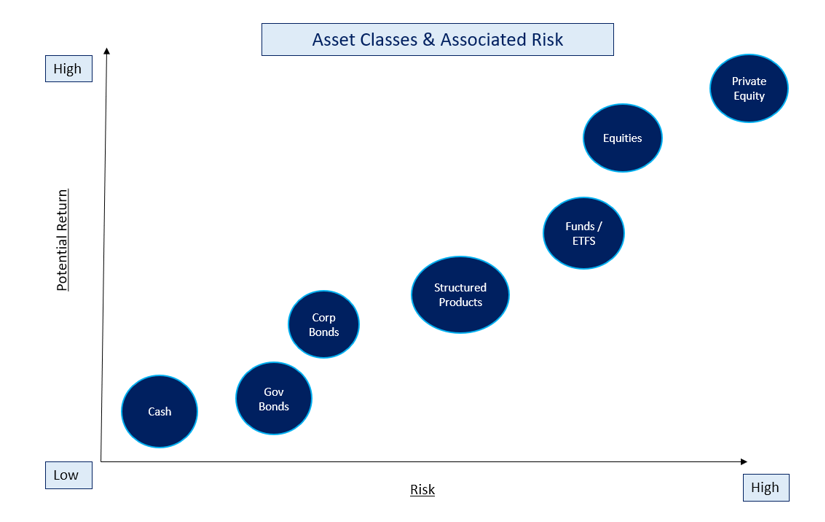

Like any investment, funds carry a degree of risk. The level of risk can vary depending on the fund’s investment strategy and the types of securities it invests in.

For example, funds that invest in stocks or high-yield bonds are generally considered to be riskier than funds that invest in lower-risk securities such as government bonds.

Return

Funds can offer the potential for higher returns than more conservative investments such as savings accounts or government bonds.

One of the key benefits of funds is that they are managed by professional fund managers who have expertise in selecting and managing investments. This can help to reduce the risk of making poor investment decisions and can potentially lead to higher returns.

Another key benefit of funds is their ability to provide investors with diversification across a range of securities. This can help to reduce risk by spreading investments across different asset classes and sectors.

How does the market value Funds?

The market value of a fund is determined by the current value of its underlying securities. The value of each security held by the fund is calculated daily based on the current market price, and the total value of the fund is then calculated as the sum of the individual security values.

For example, if a fund holds 10,000 shares of a particular stock, and the current market price of that stock is $50 per share, the value of the stock held by the fund is $500,000 (10,000 shares x $50 per share). The value of all the securities held by the fund is then added together to determine the fund’s total market value.

The market value of a fund can fluctuate based on changes in the value of the underlying securities. If the value of the securities held by the fund increases, the market value of the fund will increase as well. Conversely, if the value of the securities held by the fund decreases, the market value of the fund will decrease as well.

It’s important to note that the market value of a fund is not the same as its net asset value (NAV), which is the value of the fund’s assets minus its liabilities. The NAV is calculated daily and is used to determine the price at which investors can buy or sell shares in what is called an “open-ended” fund.

The market value of the fund may be higher or lower than the NAV, depending on market conditions and supply and demand. This can lead to situations where the shares of what is known as a “closed-ended” fund can trade at a premium or discount to their underlying net asset value (NAV) as closed ended trade at the market value rather than the NAV.

This makes it important to understand whether the fund in question is closed- or open-ended.

Typical Income from Funds

Possible income from funds will depend on its underlying assets, but will generally come from one of the following sources;

- Dividends: funds that hold stocks or equity securities may pay out dividends to their shareholders.

- Interest: funds that hold fixed-income securities such as bonds or treasury securities may earn interest income.

- Capital gains: funds that hold securities such as stocks or bonds may generate capital gains when the underlying assets increase in value.

Typical liquidity for Funds

| Investment Minimum | With fractional share trading, typically, €1 or €5. Some Hedge Funds would have much higher minimum. |

|---|---|

| Trades executed | Throughout the trading day and during extended hours trading |

| Settlement period | Mutual Funds: 2 business days (trade date +2) Some complex mutual funds can trade on a weekly or monthly basis. Hedge Fund: Typically monthly. Some complex hedge funds or fund of fund structures may only trade on a quarterly or six-monthly basis. |

Where are Funds held?

Funds will be settled with the relevant transfer agent or through a common exchange such as FundSettle. Units in the fund will be settled by, and held on account with, our Custodian Pershing Securities International Limited on your behalf. As your custodian, Pershing’s role is to hold your assets separately to other assets, ensuring these are protected against theft or loss. Pershing are responsible for recording transactions, reconciliation of accounts, execution of documents and reporting.

Where are costs associated with Funds?

Management fees: Funds charge investors an annual fee for managing the fund’s portfolio. This fee is typically a percentage of the fund’s assets under management and is known as the expense ratio. The expense ratio covers the fund’s operating costs, including salaries, administrative expenses, and fees paid to the fund’s custodian and other service providers.

Sales charges: Some funds charge investors a sales charge, also known as a “load.” There are two types of loads: front-end loads, which are charged when an investor buys shares in the fund, and back-end loads, which are charged when an investor sells shares in the fund. These charges are typically a percentage of the amount invested or redeemed.

Redemption fees: Some funds may charge investors a redemption fee when they sell shares of the fund. The purpose of the redemption fee is to discourage short-term trading of the fund’s shares, which can disrupt the fund’s investment strategy.