The Gender Gap in Financial Planning

When it comes to preparing for the future, Irish women are being left behind. Despite making up almost half of the workforce, they are far less likely than men to have a retirement plan, wealth planning or a long-term investment strategy. Career breaks, part-time work and the gender pay gap all play a part, but so too does a lack of targeted support, advice and confidence.

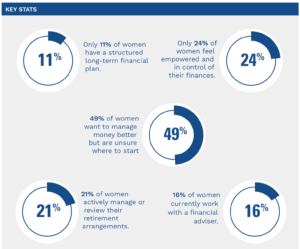

To explore this further, Cantor Fitzgerald Ireland, in partnership with IMAGE Media, surveyed more than 1,800 women across Ireland about their attitudes to money, investing and retirement. The results reveal ambition mixed with uncertainty. Many women are eager to take control of their finances but do not know where to begin. Almost half expressed interest in learning more or seeking professional guidance, showing a growing appetite for education and practical support.

This survey reinforces a clear message: women are more than capable and motivated, but too often overlooked in discussions about wealth and retirement. Closing that gap starts with understanding how women think about their finances today and helping them build confidence for the future.

Balancing Today’s Pressures with Tomorrow’s Goals

Irish women are managing competing financial priorities. Rising living costs, mortgages, childcare and family responsibilities, which still tend to fall more on women than men, make it harder to plan ahead. Many are focused on reducing debt or supporting family members while still trying to build a secure future.

When asked about their goals, most cited retirement planning, growing long-term wealth and building an emergency fund as top priorities. Others highlighted saving for children’s education or supporting ageing parents.

Only one in ten respondents said they have a structured long-term financial plan. More than half have a general sense of their goals but have yet to formalise them, while almost a third are figuring things out as they go. Retirement is one of the biggest gaps: just one in five women actively manage or review their pension arrangements, while many have only a vague idea of how their savings are invested or whether they are on track to meet their needs.

Confidence and the Value of Advice

Confidence is central to long-term planning, yet many women still feel uncertain. Only a small proportion said they feel fully confident managing their finances, while most described themselves as “somewhat confident” or unsure.

When it comes to getting practical help and advice, fewer than one in six currently work with a financial adviser, even though professional guidance is often the difference between good intentions and clear results.

There is also a broader industry challenge. Financial advice remains a male-dominated field, which can make it harder for women to find someone who understands their perspective or priorities. A more balanced adviser base could help make conversations about money more inclusive and relatable, supporting the next generation of financially confident women.

Looking Ahead

From January 2026, Ireland’s My Future Fund will automatically enrol eligible employees into a structured retirement savings plan, which will help some women. Contributions from both employers and the government will give more workers access to consistent, long-term savings. This is an important step forward, particularly for women who have been underrepresented in private pension schemes.

While My Future Fund provides a baseline of retirement savings, private pensions often offer greater flexibility, more personalised investment choices, and the potential for stronger long-term outcomes. According to our survey, only 21% of women actively manage or review their retirement arrangements, and 44% have only a vague idea of how their savings are invested. These figures highlight that a one-size-fits-all approach may not suit everyone, and many women could benefit from professional advice to ensure their retirement strategy aligns with their individual circumstances and long-term goals.

Auto enrolment will simplify access to retirement savings, but it cannot replace tailored guidance. Many women will still need help understanding how their pension fits with broader financial objectives. Employers can support this by promoting financial wellbeing and helping staff make informed decisions about their future.

Key Takeaways for Women

- Interest in financial planning is strong, but engagement remains low, and many women want to act but have not yet sought advice.

- Confidence gaps persist, with nearly half of women unsure where to start.

- Professional advice is essential, with tailored strategies helping women make informed financial decisions.

How Cantor Fitzgerald Ireland Can Help

Whether you are a woman looking to take charge of your finances or a business preparing for auto-enrolment, we can provide tailored advice on retirement planning, investments and wealth management. Cantor can help clarify financial goals and make them actionable while supporting companies in preparing employees for long-term financial security.

Taking action now ensures that financial goals become realities and that women are empowered to secure their retirement.

Written by Laura Reidy, Director of Wealth Management, Cantor Fitzgerald Ireland

Laura Reidy

Laura Reidy