The Weekly Compass: 3/2/2026

Our CIO, John Mullane, shares the latest Market News and Views and gives insights for the week ahead: Corporate earnings and ECB rates decision in focus this week

The week that was:

Global equity markets ended last week modestly higher, led by emerging markets, while European equities posted small gains supported by strength in Energy stocks. Despite a slight back up in US yields following confirmation that Kevin Warsh had been nominated as Donald Trump’s preferred candidate for Fed Chair, global bonds generated positive returns on the week.

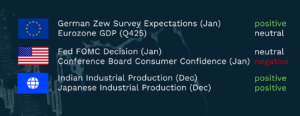

Summary economic releases

The week ahead

Asian markets followed their US counterparts higher in overnight trading as markets reacted positively to news that the US will cut tariffs on India following its commitment to halt purchases of oil from Russia. Also overnight, France passed a budget for 2026 following the Prime Minister’s survival of two no-confidence votes, ending a months-long deadlock.

In commodity markets, both gold and silver have rebounded strongly from a two-day slide prompted by the appointment of Kevin Warsh as Fed Chair, whilst the US dollar has renewed its decline, with euro/dollar trading back above 1.18.

Corporate earnings will be a key driver of market sentiment in the week ahead, which will see a raft of mega-cap names reporting, including Pfizer, Amazon and Alphabet. For the latter, there is scope for some upside to top-line consensus as advertising channel checks for Q4 were healthy. However, management may guide capex above expectations for 2026, which could unnerve some investors. Overall, with one-third of corporates having now reported, the blended earnings growth rate is running at 11.9% versus 8.3% expected at the start of the season.

In Europe, focus will centre on updates from Infineon, GSK and Novo Nordisk. For the latter, investor attention will focus on management commentary surrounding the oral and injectable Wegovy potential in the US, given the recent run-up in the share price of 13%. Closer to home, DCC and Infineon will also provide updates. The former may face revenue headwinds from lower fuel prices, so focus will be on margins. The latter is expected to generate adjusted Q1 EPS of 33c on revenue of €3.6bn. Any positive upside to automotive sales, which account for 50% of revenue, should act as a strong tailwind for investor sentiment.

Economic releases will also garner significant attention in the week ahead, particularly European rates decisions and US jobs data. Later today, the market is likely to get confirmation that 7.25m jobs were available in the US economy in December, a modest step up from the prior month. This comes ahead of non-farm payrolls data on Friday, which is likely to confirm a tepid pace of US job growth in January, consistent with a no-hire, no-fire economy.

Closer to home, whilst energy base effects could push eurozone headline inflation further below 2% in January, the core reading is expected to hold steady at 2.3%. Current inflation trends are likely to keep both the BoE and ECB on hold when they meet for their first policy meetings of the year on Thursday. Recent currency strength relative to the dollar will likely loom large over deliberations and influence the tenor of post-decision commentary.

Written by John Mullane, CIO, Cantor Fitzgerald Ireland

John Mullane

John Mullane