Preparing for Retirement

Approaching retirement is a key milestone in managing your personal finances. As individuals near the end of their careers, the emphasis often shifts from building wealth to preserving it and generating sustainable income. However, retirement planning should not happen in isolation. It is an essential element within a broader wealth management strategy.

There are generally two main approaches to retirement planning: focusing on a target annual income or building a total retirement pot. Each has its advantages, and the most suitable choice depends on personal circumstances and preferences.

Approach 1: Target Pot Approach

For some, working towards a specific retirement pot provides a clear and motivating goal. This might involve aiming for the Pension Standard Fund Threshold (SFT), which is currently €2 million and set to increase by €200,000 annually, reaching €2.8 million by 2029. Alternatively, you may set a target to build a pot capable of replacing approximately two-thirds of your pre-retirement income. A useful benchmark to track progress is accumulating one times your annual salary by age 35, three times by 45, seven times by 55, and eleven times by 65. This provides a rough guide to building sufficient retirement savings.

However, it is important to ask yourself if you are confident that this pension pot will provide the level of income your family will need. While this approach offers control over your financial future, it often overlooks other income sources and does not fully account for personal factors, such as increased spending during the early years of retirement

Approach 2: Target Annual Income for Desired Lifestyle

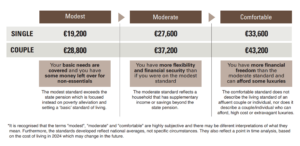

Alternatively, you can focus on identifying the annual income required to maintain your desired lifestyle in retirement. This approach can seem complex, but it becomes much more manageable when integrated into your wider financial plan. Retirement planning works best when aligned with your overall wealth strategy. According to research by the Retirement Council of Ireland, in collaboration with KPMG, a comfortable retirement for a couple requires approximately €43,200 per year

Does that figure align with your expectations? How much income will your family realistically need? To estimate this, start by reviewing your current lifestyle costs and deducting expenses that are unlikely to continue into retirement, such as mortgage repayments or education-related spending. You should also factor in additional costs that might arise, such as hobbies, home improvements, holidays, or family celebrations. Once you have a clear view of expected expenses, assess your potential retirement income sources. These may include private or public service pensions, the state pension, rental income, investment returns from your portfolio, pension lump sums, business sale proceeds, or the value released from downsizing your home.

The key is to calculate the gap between your expected income and anticipated expenses. Understanding this shortfall will help shape your strategy, whether through additional pension contributions or growing your investment portfolio, to close that gap effectively.

Retirement Today is Changing

Retirement today looks very different to previous generations. Many people now prefer a phased approach, gradually transitioning by working part-time for one to three days a week, often continuing this well into their seventies. This allows individuals to maintain a sense of purpose, stay socially connected, and enjoy greater flexibility.

Good health during the early years of semi-retirement enables people to maximise this period, often front-loading their plans with travel, home renovations, or other personal ambitions within the first 10 to 15 years. Your personal goals, alongside your family’s priorities, should be fully integrated into your retirement plan to ensure your resources are allocated wisely and support a fulfilling life post-retirement.

The Final Countdown: Five to Ten Years from Retirement

The five to ten years leading up to retirement are critical. You are often at the peak of your earning potential, making this the ideal time to review and refine your financial strategy. During this period, it is essential to regularly review your financial plan and adjust as your income, expenses, or market conditions change. Maximising pension contributions is equally important, as this allows you to benefit from available tax reliefs and employer contributions. It is also a good time to align your investment strategy with your evolving goals and reduce outstanding debts, aiming to enter retirement with minimal liabilities.

Another key consideration is structuring your retirement income drawdowns in a way that supports your financial objectives and optimises tax efficiency.

Retirement Planning as Part of a Broader Strategy

Ultimately, retirement planning is just one part of your overall financial journey. A comprehensive, well-considered financial plan helps you make better decisions that align with your values and long-term goals. By proactively addressing factors such as long-term inflation, increasing life expectancy, and healthcare costs, you give yourself the best opportunity to enjoy a secure, fulfilling, and financially confident retirement.

One client, a business owner, approached us seeking to maximise his pension fund to €2 million within five years, ensuring it could support his desired retirement lifestyle. After a detailed review of his financial situation, it was clear a comprehensive plan was needed. His retirement income would come from multiple sources, including the state pension, rental income, and private pensions. However, his primary objective was passing wealth to his children as tax efficiently as possible.

Our recommendations included using pension contributions as a tool for tax-free growth, increasing company contributions, and setting up a pension for his spouse to maximise tax-free lump sums. We also collaborated with his tax adviser to structure the business for Entrepreneur Relief, enhancing the benefits of a future sale. Additionally, we advised deferring pension drawdowns, as existing rental income already provided sufficient earnings.

Written by Marta Pelc, Advisor, Cantor Fitzgerald Ireland

Marta Pelc

Marta Pelc