Ryanair: Continues to Soar Post Pandemic

In late September, we reiterated our Buy recommendation on Ryanair while increasing our price target to €22.75, up from €19.44 previously.

With the stock trading at an over 40% discount to its pre-pandemic average valuation, despite the fact that it has substantially improved its competitive position relative to peers, we believe that it is materially undervalued and the long-term investment case for the airline is very strong. As such, the stock remains on our Analyst Conviction List.

Whether it was the long queues at popular tourist attractions or beaches packed with holidaymakers, for anybody who travelled to mainland Europe this summer, it was clear to see that the post-pandemic tourism recovery had continued despite ongoing cost-of-living pressures and increasing concerns over an economic downturn. Data produced by travel research company ForwardKeys further illustrated this, showing that during the summer months there was a 25% YoY increase in flight bookings to Northern Europe and a 13% increase to Southern Europe. These figures support research carried out by the European Travel Commission which found that travel was the only discretionary expenditure that consumers would allow for regardless of the economic conditions.

Looking forward to the winter months, Micheal O’Leary has warned that he is cautious, and he believed that lower fares would be required to stimulate demand. However, given that winter bookings are 3- 4% higher than they were last year and O’Leary’s tendency to “under promise and over deliver”, it is possible that he is being overly pessimistic. Whatever the case, with the muted share price response in the day following these comments from Ryanair’s CEO, it appears that the recent rally in oil prices has been the main driver of airline stocks in recent times. However, with Ryanair almost 85% hedged at approximately $89 a barrel for FY24, the airline’s operational expenditure has limited exposure to short-term volatility in the oil price.

Ryanair’s CMD, in early September, was aptly named “A Decade of Growth”, with management boldly announcing that it was targeting 300m passengers per year by 2034, which would in turn generate PAT of €3bn. The company will require a fleet of 800 aircraft and PAT per passenger of €10, a 49% and 25% increase on the respective FY23 figures to achieve this goal. In its presentation, management outlined the growth potential in its current markets, highlighting the notable opportunities in Spain, the UK and Germany where it estimates that an additional 340 aircraft will be required to satisfy demand in ten years’ time. To support its ambitions, Ryanair has hired 4,000 staff in recent years, and plans to recruit an additional 10,000 personnel over the coming years. Management is confident that it can build up and sustain the resources required to accommodate such a significant period of growth. This will be key if Ryanair is to fully take advantage of the opportunity that it envisages in European air travel.

Source: CFIL, Ryanair Capital Markets Day Presentation 2023

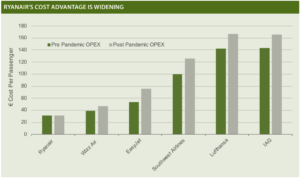

Ryanair boasts not only a significant scale advantage relative to its peers by having the largest fleet, but also that it has the lowest cost base by a growing margin. The airline’s € cost per passenger has remained stable in comparison to its pre-covid levels, while competitors like Wizz Air and EasyJet have each seen their unit costs increase by 20% and 43% respectively. It is fully expected that as the Max- 10’s and B-8200 “Gamechangers” become a larger proportion of Ryanair’s fleet, this cost advantage will widen further. These aircraft will require less maintenance as they will have less miles under their belt, the crew costs will be spread over more passengers, and they will be far more fuel efficient than the existing fleet (Max-10 burns c.20% less fuel). In addition, Ryanair Labs, which has been a core element of driving efficiencies in the airline’s operations since 2014, now incorporates AI tools, which were highlighted at the CMD as crucial to the airlines scalability to support its long-term growth plans.

As has traditionally been the case, Ryanair continues to have an industry leading balance sheet (-0.3x Net Debt/EBITDA(LTM)). Its last reported gross cash position was just shy of €5bn and liquidity is expected to remain in the €3-3.5bn range over the next few years as Ryanair looks to fund its ongoing CAPEX. In addition, excess cashflow will also be deployed to reduce the airline’s debt, which is expected to be fully repaid by 2026. Furthermore, there remains considerable scope for shareholder returns. Investors provided the airline with a €400m cash injection during the pandemic and O’Leary has indicated that Ryanair will pay a dividend somewhere close to this figure. This commentary would lead us to believe that there is potential upside to both our (€365m), and the streets dividend expectations for FY24.

During the five years prior to the pandemic, Ryanair traded at an average PE multiple of 13.85x and an EV/EBITDA multiple of 8.5x. The airline has emerged from this difficult period with its competitive position strengthened and a clear vision of its growth prospects over the next decade. As a result, with the shares currently trading at 10.1x FY24 EPS and an EV/EBITDA multiple of 5.7x, Ryanair appears materially undervalued. As such, taking the mean of the implied share prices using the pre-pandemic PE and EV/EBITDA multiples, we recently increased our price target to €22.75, up from €19.44 previously. This provides investors with 42% potential upside, supporting our unchanged Buy recommendation.

John Blake

John Blake