Celebrating Three Decades of Excellence: A Closer Look at Cantor Fitzgerald's Multi-Asset 70 Fund

Cantor Fitzgerald Asset Management (CFAM) recently celebrated the 30th anniversary of its flagship Multi-Asset 70 Fund. This significant event not only marks three decades of sustained success but also highlights CFAM’s exceptional performance, consistently ranking as Ireland’s top performing pension and investment fund manager since its establishment1. With a history dating back to 1986, and following its acquisition by Cantor Fitzgerald Ireland in 2018, CFAM’s journey is one of strategic growth, innovation and commitment to its clients.

A Tradition of Excellence

CFAM’s dedication to excellence is further evidenced by its core multi-asset funds, each awarded a 5-star rating by Morningstar, which is preserved for the top 10% of similar funds rated on a global level. CFAM has more than thirty years’ experience of managing investment portfolios for a range of clients, including religious orders, private and corporate pension schemes, and high net worth individuals. With assets under management reaching approximately 2 billion euros, CFAM’s impact and influence extend across the financial spectrum.

Investment Philosophy

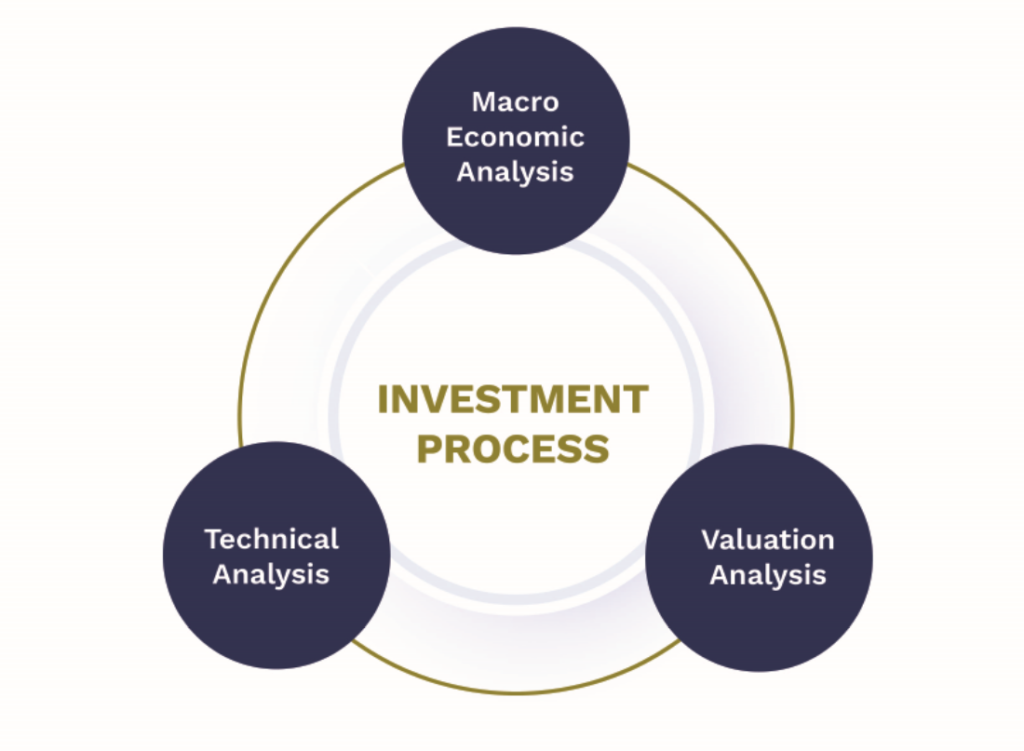

At the heart of CFAM’s success is its investment philosophy, which stands apart from traditional investment management structures and processes, typically organised around asset classes and regional markets. Instead, CFAM employs a three-pillared approach centered around macro-economic, technical, and valuation analysis. This methodology has proven to be highly effective, offering a robust, proven, and adaptable strategy that has weathered various market conditions.

Pearse MacManus, CFAM’s Chief Investment Officer, emphasises the critical role of this three-pillar process in the firm’s long-standing success. “The robustness of our three-pillar process has been pivotal to our decades-long success, consistently driving long-term outperformance for our clients. As genuine active managers, to be able to rely on our proven investment process through very different market conditions gives us confidence in our approach.” Pearse also emphasises the importance of a flexible investment approach in rapidly evolving market environments. He notes, “There have been many significant events impacting markets over the past 30 years. While we do not claim to get every decision right over all time periods, the combination of our investment process and being fleet-footed in the active management of our funds, has meant that we have delivered outstanding returns for our clients over all the key time periods.”

Celebrating the Multi-Asset 70 Fund

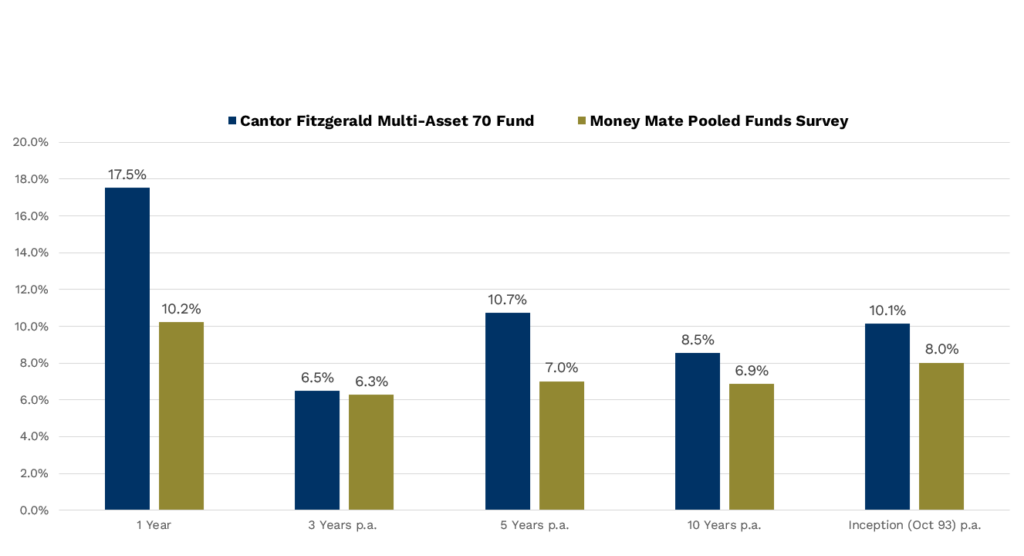

Source: MoneyMate & CFAM as at 31.12.2023. Fund performance figures are quoted gross of all management fees.

The 30th anniversary of the Multi-Asset 70 Fund is a focal point of CFAM’s celebrations, showcasing the fund’s remarkable performance. Kevin O Kelly, Head of Sales and Marketing at CFAM, discusses the impressive performance of the Multi-Asset 70 Fund. “The table above compares the investment returns of our 70 Fund to its benchmark, which is based on the MoneyMate survey of all similar funds in its risk category within the Irish market, over various periods.

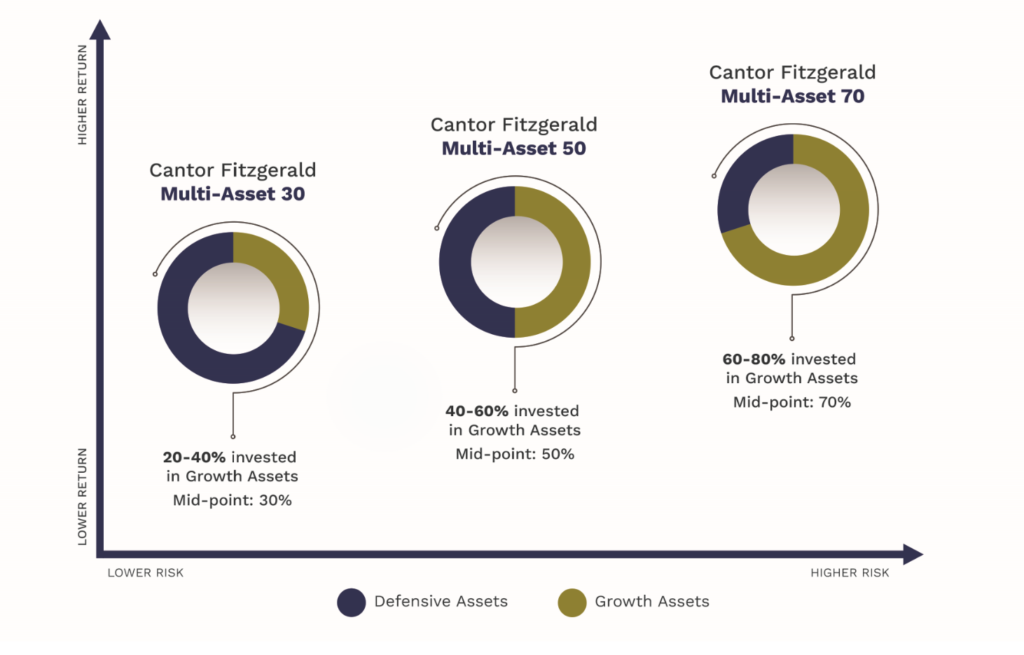

Beyond the Multi-Asset 70 Fund, CFAM also oversees the Multi-Asset 50 Fund and the Multi-Asset 30 Fund, both of which are designed for lower risk profiles yet adhere to the same strategic decision-making principles. The flexibility offered by these funds allows investors to tailor their portfolios to their specific risk tolerances and investment objectives backed by daily pricing and full liquidity. For further information please contact your portfolio manager.

1Source: Based on the MoneyMate/Longboat Analytics pooled fund average Benchmark (Managed Aggressive >65% Equity)

Fearghal Lawlor

Fearghal Lawlor