Navigating Market Volatility: The Power of Diversification in Uncertain Times

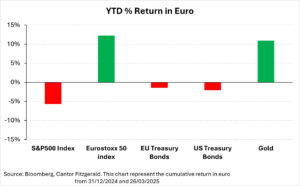

It’s certainly been a volatile market this year, leaving investors uncertain about what’s ahead. The S&P 500, which saw strong gains after the 2024 election, has now lost those gains and is down almost 5% in euro terms since the start of the year. With growing concerns about the trajectory of the US economy, the market has been reacting to shifting factors such as political uncertainty, weak economic data, and unexpected policy moves.

The S&P 500 had a strong start, boosted by the optimism after Donald Trump’s re-election. However, the market has faced significant challenges this year, mainly due to growing uncertainty about the US economy. The S&P 500 has been especially hard hit, losing almost 10% at one stage since January 2025. The fear of an economic slowdown has led investors to reassess their positions, and the stock market’s volatility is reflecting these changing expectations. Indeed, companies are rushing to import goods before tariffs increase, and political and policy uncertainty is affecting consumer confidence, causing both businesses and consumers to be more cautious about the economy’s future.

So what does that mean for the investor? How worried should they be? And what can they do to mitigate the uncertainty? In times like these, the key strategy is diversification, which will help manage risk and make the most of your investments.

The recent ups and downs in the US stock market show just how quickly a strong rally can turn around, highlighting the need to spread investment risk across different asset classes and regions.

Diversification is not just about holding different stocks. It involves mixing asset classes, such as bonds, equities, and commodities, across various geographies to reduce exposure to any single market risk. For example, while US stocks are struggling, European stocks have outperformed in 2025. Improving sentiment around the Russia-Ukraine conflict, as well as rising defence spending in Europe, has boosted European equity markets.

In these challenging times, having a well-diversified portfolio is more important than ever. By focusing on diversification and risk management, investors can optimise their portfolios for long-term growth while also being structured to weather short-term market fluctuations.

_______________________________________________________________________________

At Cantor Fitzgerald, we can help investors with a range of diversified portfolios. Our discretionary service is designed with one goal in mind: to help navigate market cycles with confidence. By focusing on diversification and risk management, our portfolios are not only optimised for long-term growth but also structured to weather short-term market fluctuations. Get in touch with us to find out how we can help you.

#S&P500 #Diversification #DiscretionaryInvestment #ThisIsAMarketingCommunication

Leonardo Mazza, Head of Cross Asset Strategy & Fund Manager, CFIL

This is a Marketing Communication

Leonardo Mazza

Leonardo Mazza