Plenty of Market Opportunities on Offer for Investors in the Second Half of the Decade

This is a marketing communication.

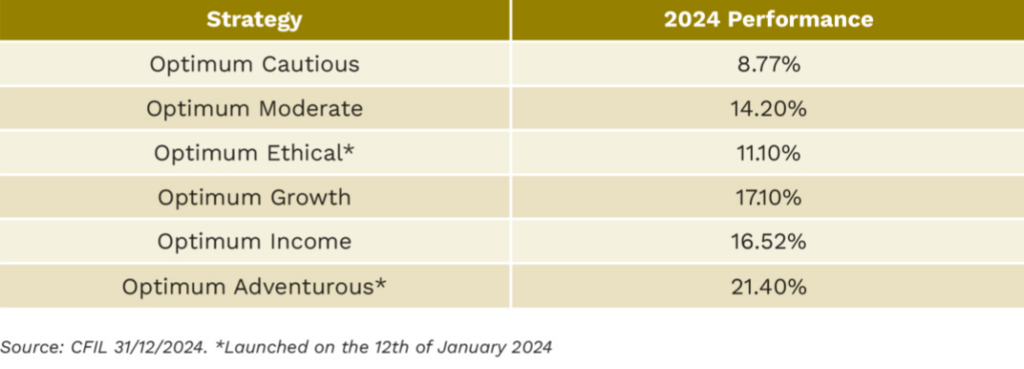

We close out the first half of the decade with markets sitting close to all-time highs despite having had to navigate major external shocks including the outbreak of war in Europe and the Middle East, the Covid-19 pandemic and the sharpest spike in interest rates and inflation in decades. Significant progress was made in the multi-year battle against inflation last year, clearing the path for monetary easing in the US and Europe, which combined with low unemployment, rising real incomes, and AI developments resulted in 2024 being another good year for risk assets.

Looking into 2025, global GDP is set to grow at a healthy 3.0%, corporate earnings should also expand, which combined with a careful and methodical easing of financial conditions provides a healthy backdrop for equities. Within the US, with pockets of overvaluation evident and markets increasingly concentrated overall, an active approach will be key to ensure effective portfolio diversification. There remains plenty of attractive opportunities on offer however, particularly in areas such as small-cap where valuation discounts relative to their large-cap peers are at historically elevated levels and for whom the tax cutting and deregulation agenda of the new Trump administration will bring significant benefits. Whilst rising tariffs will pose a risk, it’s yet to be seen what shape they will take.

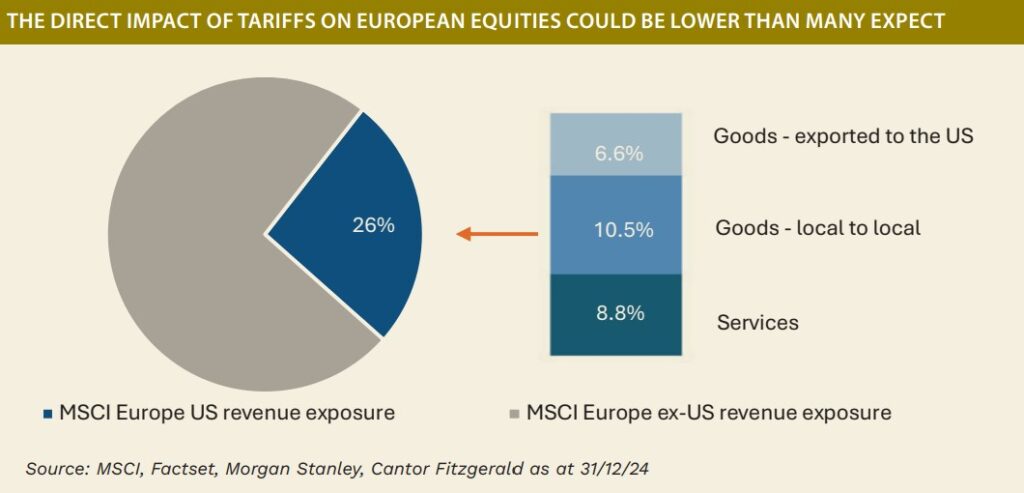

The shape and scale of these tariffs will have significant implications for returns in emerging markets, particularly China, where reactive stimulus measures will likely be needed to act as a counterbalance to cushion its economy from the worst of these trade restrictions. These trade tensions will also place European listed companies in the crosshairs, however a transactional approach to trade negotiations combined with the fact that only 6.6% of goods exported to the US fall in scope for direct tariffs will likely provide some insulation. With European economic and corporate earnings growth set to accelerate, albeit modestly, in 2025 and valuations attractive on a relative basis, sentiment could turn more positive, provided progress is made on promised EU structural reforms and some semblance of political stability returns to the region’s largest players.

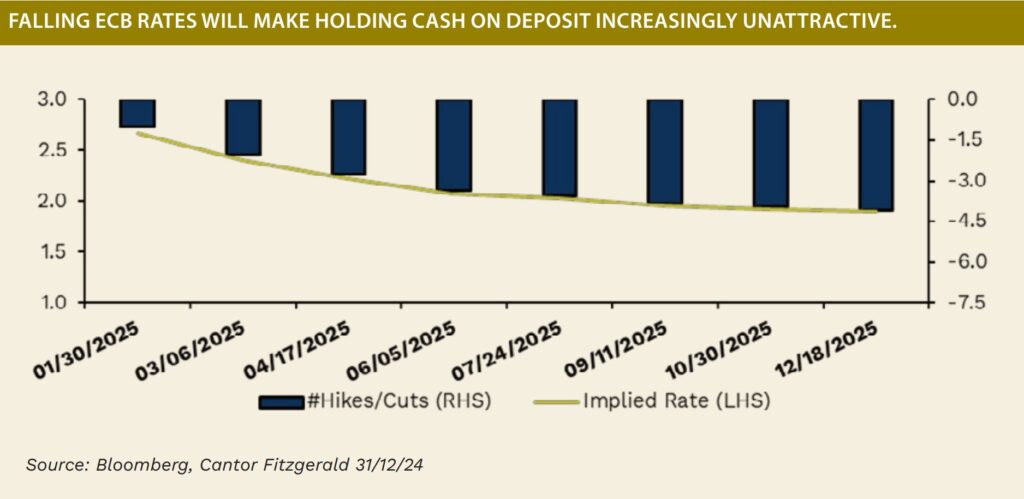

In fixed income markets, most global central banks remain in easing mode as they seek to bring rates to a level that is neither stimulative nor restrictive. Whilst the pace of those cuts is likely to move at a slower cadence from here, investors should position for lower rates as the relatively attractive yields on cash today are unlikely to be present in a year’s time. As a result, cautious investors should ensure their cash continues to work for them by exploring opportunities in longer dated bonds and in particular alternatives such as global Infrastructure, which could offer an attractive combination of capital returns and income in 2025.

Overall, as we pass the mid-point of the decade it represents a good opportunity for many to review their objectives and tolerance for risk to ensure their portfolio is well positioned to navigate the challenges and capitalise on the considerable opportunities available across financial markets in the years ahead.

John Mullane

John Mullane