Lower Interest Rates on the Way in 2024

US economy likely to out-perform Eurozone again this year

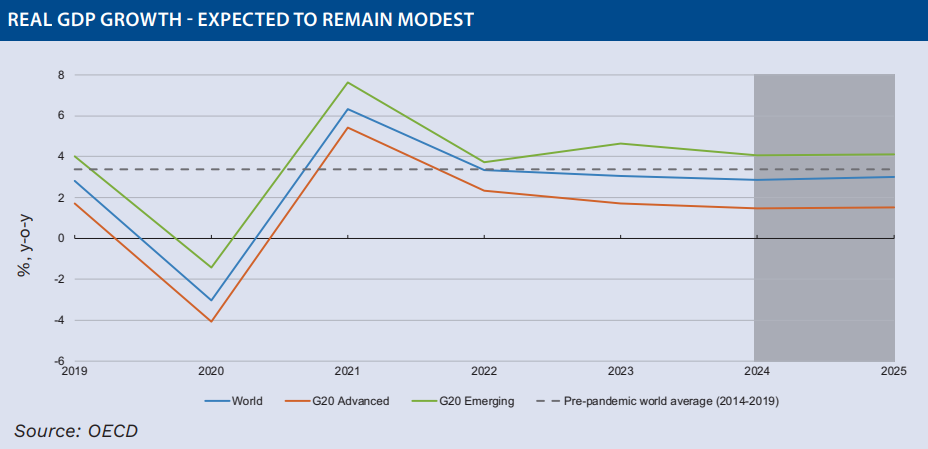

World economic growth was better than expected in 2023 and inflation fell at a quicker pace than forecast at the start of last year. However, there was a marked contrast in the growth performances of the major economies. National output was strong in the United States throughout the whole of 2023 helped by healthy consumer spending, with households continuing to deplete the excess savings that were run up during the pandemic. In contrast, European economies struggled as the adverse effects of the energy price shock continued to bite. The reopening of the Chinese economy at the beginning of last year helped to boost economic activity in the world’s second-largest economy, but weak consumer spending and the ongoing contraction in the country’s property sector continued to weigh negatively on domestic demand.

Looking ahead to 2024, there are some signs that US consumers are pushing back on the purchases of big-ticket items. But the housing sector appears to be on the road to recovery and that should boost economic growth. On top of that, fiscal spending in this election year will also help to lift GDP. At this stage it looks like the world’s largest economy is set to grow at a rate close to the longer-term trend of 2.0% over the next six to nine months. Over in Europe, economies continue to struggle but lower energy prices should help to take the pressure off households to some degree. However, both fiscal and monetary policy remain headwinds in the near-term and as such it is hard to see the region posting significant growth anytime soon. Meanwhile, Chinese economic growth is likely to fall short of the government’s 5.0% target as the struggling property sector, ongoing trade wars with the West and a poor demographic landscape prove challenging.

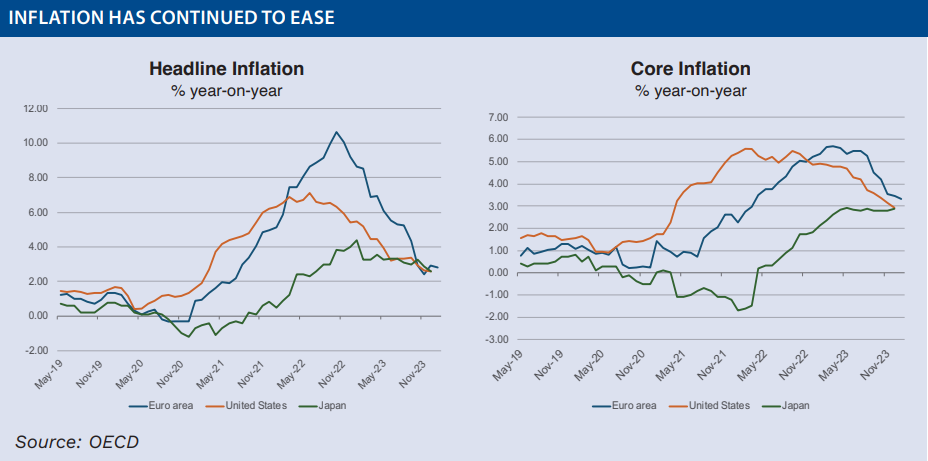

Headline inflation rates falling but core inflation proving trickier

Goods price inflation dropped to low levels in most countries last year, helped by falling energy costs and the gradual easing of supply chain bottlenecks from their earlier peak in 2021-22. However, services price inflation has generally proved stickier, drifting down only slowly. Still, the generalised easing of inflationary pressures has helped to quell fears that price expectations would become entrenched. In some countries, annual headline inflation rates have already dropped back to or below official targets, though core inflation has yet to do so. The worry is that some of the factors that were key in bringing about disinflation over the last twelve months, such as past improvements in supply chains and falling commodity prices, are now dissipating or reversing. We have already seen the tensions in the Red Sea which has impacted on the supply and price of goods worldwide in the early part of the year. Geopolitical developments, extreme weather events and other exogenous shocks all remain a risk. With core inflation still above target in most countries and unit labour cost growth generally remaining above levels compatible with medium-term inflation objectives, it is still too soon to be certain that the inflationary episode which began in 2021 will end in 2024.

Monetary policy needs to remain prudent

With inflation falling, there has been a clamour for the world’s major central banks to start cutting interest rates sooner rather than later. Indeed, there have been recent comments from a number of Fed, ECB and Bank of England officials that point to their respective easing cycles beginning at some point over the Summer months. Still, monetary policy needs to remain prudent to ensure that underlying price pressures stay well contained. How quickly and how much rates are cut will be at the mercy of the data and will likely vary across countries depending on economic conditions. Stable goods prices, a continued narrowing of supply and demand imbalances in labour markets, and declining cost and price pressures in service sectors will all be key factors helping to determine the timing of policy rate reductions. There is greater pressure on both the ECB and the Bank of England to ease monetary policy than there is on the Fed given the weak economic outlooks in the Eurozone and UK, and notwithstanding they only have a single mandate each which is to ensure price stability. The foreign exchange implications of an early rate cut will also need to be taken into account as a weakening currency could re-ignite inflationary pressures.

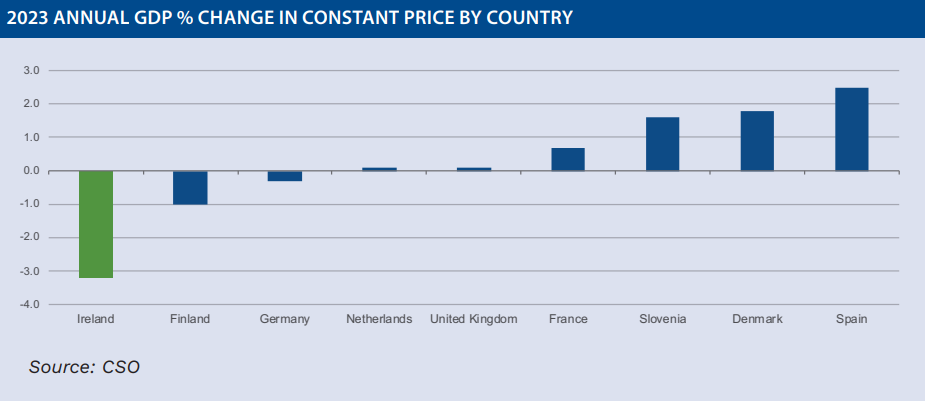

Irish economy falls by over 3.0% in real GDP terms last year

The most recent figures from the Central Statistics Office (CSO) showed that Ireland’s GDP fell by 3.2% in real terms in 2023 due to a contraction in the multinational dominated industry sector, in particular pharmaceutical companies. As a result, the country was for once at the wrong end of the EU growth league table. In contrast, modified domestic demand, which more closely tracks the domestic economy, rose by 0.5% last year, but still well below the government projection of 2.2% and came after a continued fall in investment in the final quarter of 2023. The CSO said that the more globalised sectors of the economy contracted for the first time since 2013 with Industry shrinking by 11%, but added that the Information & Communication sector continued to grow and increased by 8%. Within the Industry sector, the decrease was predominantly driven by a shrinking pharma cohort, as the production and export of medicines from here during the Covid pandemic dropped back to more normal levels. However, early trade figures for 2024 point to a strong rebound in pharmaceutical exports which augurs well for the rest of the year. On the trade front, analysts and government officials will also in the coming months be keeping a close eye on the domestic food and agriculture sector in light of new border controls with the UK introduced at the end of January. Despite the conflicting signals that the Irish statistics can provide, the ongoing resilience of the labour market is a more reliable gauge of the economy. Employment growth is strong and the unemployment rate remains low, and has not risen in a manner suggesting an imminent decline in underlying economic activity. Taking everything in the account, the signs at this stage are that Irish economic growth will rebound this year albeit in low single digits and well down on the annual rises we’ve seen in national output over the past decade or so.

Alan McQuaid

Alan McQuaid