Analysis Snapshot: FedEx Remains One of the Key Independent Enablers of eCommerce Delivery

After many years of organic and inorganic growth they are undertaking a root and branch reorganisation to improve efficiency and profitability. We maintain a Buy with $338 target price.

Gradual return to the long-term growth trend

Following years of steady growth in revenues driven by the rise of eCommerce, in FY2020 FedEx experienced a growth setback with the end of its delivery contract with Amazon, which accounted for c. 1.3% of FedEx’s revenue, shortly after this the Covid-19 pandemic hit and the surge of home shopping and delivery bottlenecks significantly benefitted FedEx, which saw two years of rapid operating profit growth (+29% and +36% in FY2021 and FY2022 respectively).

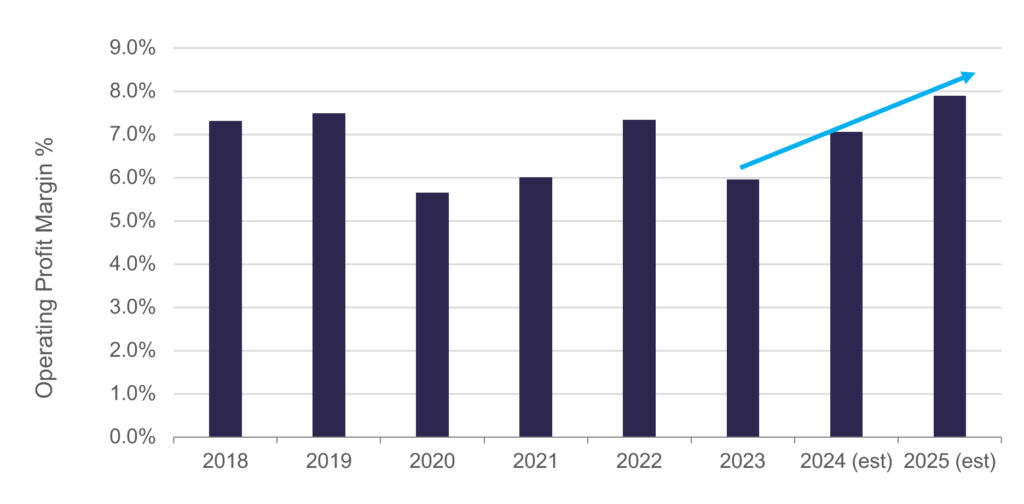

With the gradual return to the long-term growth trend in the industry, FedEx is in the latter stages of a revenue pull back (-3.5% and -2.7% (est.) in FY2023 and FY2024). Also, the US Postal Service (USPS) and FedEx have failed to agree on a mutually beneficial contract extension and summer 2024 will see the end of this 20+ year relationship. USPS is estimated to be about 1.5% to 2% of FedEx’s revenue. The underlying growth expectation for the industry is now in the low single digit level (~3%) in the US as the sector has matured, whilst international growth is higher, giving a blended 4-6% growth in the medium term. Therefore, as a result of post-COVID excess capacity, industry competitive challenges, and having grown its network steadily over 50 years into an unwieldy behemoth, the company decided in 2022 to implement a significant restructuring plan.

The DRIVE Programme

This restructuring plan is called the DRIVE programme and incorporates the major sub- programme, Network 2.0. Targeted cost savings from DRIVE amount to $4bn to 2025, compared to a baseline 2023 operating profit of $5.3bn and operating cost base of $84bn. Furthermore, the Network 2.0 plan is expected to lead to a further $2.0bn cost reduction by 2027. The DRIVE programme is a large scale, companywide initiative targeting multiple areas. The company aims to save $1.2bn from Surface transport, $1.3bn from Air Networks & International, and $1.5bn from General & Administration, with clear targets for each sub-area of each operating segment. Improving the overall customer experience, through improved customer interactions, package tracking technology, and overall service is a non- financial aim. Significantly, management plan to reorganise the business with the amalgamation of seven operating companies into one FedEx and changing reporting structures to focus on customer segments rather than on separate physical delivery channel segments. The aim is to implement an interoperable network, with reduced redundancies and fewer overheads. Network 2.0 specifically aims to consolidate operating networks, optimise routes, reduce facility footprint, and improve local pickup and delivery efficiency.

The company appears on track to implement these savings as they have confirmed the interim $1.8bn target for FY24 multiple times.

Recent results show solid progress on the cost plans despite the expected revenue headwinds and inflation-driven cost impacts. For Q3 2024 results were much better than consensus with adjusted EPS up 13.2% YoY, giving an 11.1% beat, whilst adjusted operating profit (OP) was up 16.5% YoY and was 9.4% greater than estimates. This margin improvement was achieved despite a 1.9% fall in revenues primarily due to execution of the DRIVE transformation programme and a continued focus on revenue quality. At the divisional level, Express’s revenue was weak (-2.4%) as expected, but its margin had a substantial beat, rising 109% YoY, 113% greater than expectation. Ground was broadly in line and grew OP 14.2%. Freight was weaker than forecast at both the top line and bottom line, missing OP by 13.6%.

Capital Allocation

Regarding capital allocation, it is also worth noting that FedEx has significantly improved free cash flow generation versus the pre-COVID period and continues to lower capital intensity. A new $5bn share repurchase scheme was announced, in addition to the ongoing $2.5bn expected to be completed in 2024. Capital spending guidance for FY2024 was reduced to $5.4bn, compared to the prior forecast of $5.7bn.

The stock historically trades at a 17% discount to US industry peers. Applying the historic discount to current forward peer average PE gives our target price of $338, based on expected FY26 EPS of $23.5.

If you’d like more information, please reach out to your dedicated broker.

Peter De Lacy

Peter De Lacy