Falling Inflation and Rising Economic Activity a Positive, Rare and Potent Combination

Our year ahead outlook in early January was met with incredulity by one fellow investment professional.

“How are you not worried about the Houthis?”

Not really knowing much about the Houthis, it was a hard one to respond to. Three months on I probably know less about the Houthis, but I’m still not worried about their lasting impact on our funds; nor Putin, nor Trump or whatever the crisis de jour is.

Risks, crises and unknown unknowns have and will always exist. Over the last five years we have faced pandemics, wars, the cost-of-living crisis and countless other “unprecedented” events. For an active Asset Manager, each event needs to be monitored, managed and risk adjusted for but also seen in context of what limited impact ultimately they will have on even medium term returns. The FT recently described this modern doom scrolling phenomenon as “Bleak Chic”. They wrote how there is –

“an ingrained belief that gloom, however hysterical, equals seriousness. It is a habit of educated people to accord a spurious integrity to the morose.…. A pessimist is never disappointed — or accountable.”

In the month that Daniel Kahneman passed away, his work on the irrational behaviour of investors has never been more relevant.

Our flagship CFAM 70 fund has returned over 70% over the last five years, a market leading return. It is already up over 10% year to date. As we look ahead into 2024 and the next five years, I list some reasons below why I don’t think one should be worried about the Houthis. More importantly these reasons highlight why the funds remain fully invested and why there is cause for optimism for the next five years. Recent changes to the portfolio have a particular emphasis on stocks offering value and exposure to a cyclical pick up in certain sectors that have been weighed down by two years of rate increases.

Why I’m not worried about the Houthis

- We’ve seen a five-month rally in equities almost unmatched since the 1930’s which has seen global markets at all-time highs as we enter Q2.

- The number of stocks and sectors driving the market higher continues to broaden dispelling the myth that this is all tech.

- There will be $1 trillion of share buybacks in the US in 2024; a record

- Western economies at full employment despite going through the largest and fastest rate hiking cycle in monetary policy history.

- The SNB just cut rates, kicking off a western rate cutting cycle.

- ISM manufacturing just crossed back above 50 for the first time since October 2022 indicating an economic expansion to come.

- Six previous times the ISM crossed back above 50 the US market was up every time one year out with an average return of 22%.

- Real wage inflation is at the highest in decades yet, so too are profit margins.

- Gas prices in Europe have fallen over 90% from the summer of 2022 and we’re now using the Ukraine to store excess capacity

- Inflation peaked 18 months ago and has fallen every month since.

- European core CPI just came in below 3% (2.9%) for the first time since March 2022.

- European Headline inflation peaked at 10% in 2022 is now 2.4%.

- US Earnings continue to grow and lead indicators show no signs of this abating.

- US productivity appears to be double of the 10-year average and that’s even before the AI benefits materialise.

- Commercial real estate rents in Central London for prime offices are rising.

- Current assessments of US GDP are being revised higher and this shows no signs of abating when one considers the level of residential and non-residential capex ahead as there is a shortage of:

– Data centres for the way we want to communicate.

– Planes for the way we want to travel.

– Houses for the way we want to live.

– Grid capacity for the way we want to consume energy.

– Turbine manufacturers for how we want to decarbonise.

– Green Buildings for where we want to work.

– High-end computers for how we want to process data.

– Copper for how we want to decarbonise.

– Defence spending for who we want to be allied with.

– Skilled workers to deliver all the above.

- Technology investors can gain exposure to the most exciting AI investment cycle since the dawn of the internet.

- Value investors can get 15% returns from banks with fortress balance sheets and bad debts which are falling.

- Green investors are seeing their universe broaden as the decarbonisation and electrification of the West gathers pace at terms beginning to tilt slightly back in favour of those providing the capital.

- The Fed shrank its balance sheet and the financial system survived.

- The BOJ moved interest rates off zero for the first time in 15 years and the Japanese stock market made an all-time high.

- The Tories are being kicked out of government, Sinn Fein aren’t getting into government, and neither is Donald Trump.

- The global risk-free rate of return is now between 4-5%.

If all that isn’t enough, the next crisis that hits the Fed and Central Banks globally have about 500bps of rates cuts to go.

There are areas of concern which should be avoided but they are not existential:

- Chinese property market continues to unravel.

- Consumer spending on goods is slowing.

- The relative valuation of certain technology stocks is questionable.

- The US political cycle is going to be fraught.

- The potential for the ongoing tragic conflicts in the Middle East and Eastern Ukraine to escalate.

Falling inflation and rising economic activity is a rare and very potent backdrop for the funds to continue their recent history of strong returns. The CFAM range of funds enter Q2 at the upper end of their risk asset allocation but with significant changes to holdings. We are now underweight on Technology having sold practically all our holdings in certain Megacap tech stocks like Apple and Microsoft. We have reduced our exposure significantly to GLP1 drugs as share prices now more fully reflect vast opportunity ahead.

Our largest overweight in sector terms is now Industrials, especially stocks whose end markets are benefitting from the acceleration of the worlds need to electrify. Financials are our second largest overweight due to an unprecedented cash return story ahead as the economy not only avoids a recession but begins to reaccelerate. We also have investments in numerous deep value single stock turnaround story, especially those with new management (Siemens Energy, Disney, Boeing for example). A regional overweight to note is our positioning in the UK. A decade of underperformance sees a spate of high-quality assets on sale at good value as both the rate and political cycle are turning favourably. Banks and REITs stand out. From a factor perspective the overweight to highlight is Cyclical Value (Autos, Housebuilders for example).

Philip is the Deputy Chief Investment Officer, Head of Equity Investments, CFAM, with over 15 years’ experience in the industry.

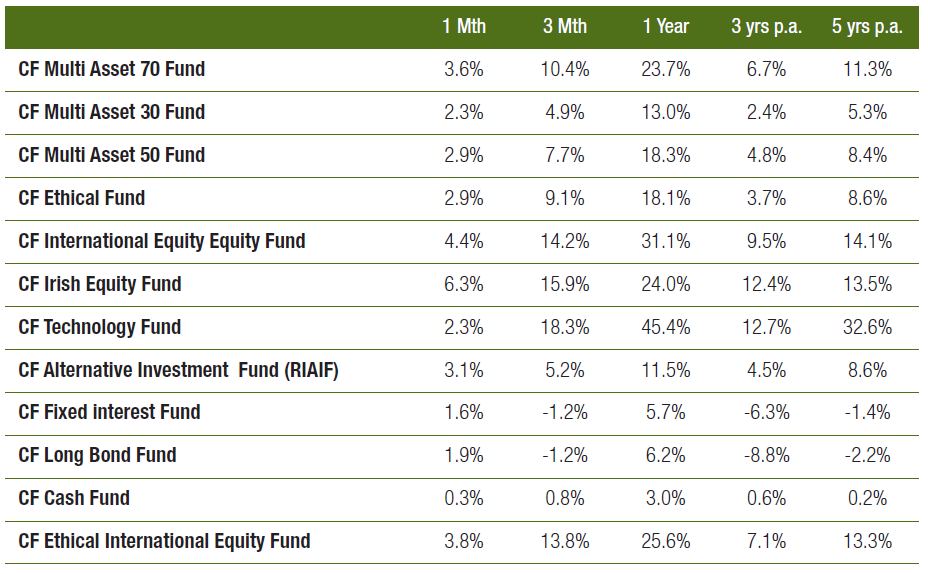

Cantor Fitzgerald Asset Management Funds

31st March 2024

*Annualised Gross Returns. Source: CFAM 31/03/2024

Cantor Fitzgerald Asset Management Core Funds

Performance figures above are quoted gross of management fees.

Philip Byrne

Philip Byrne