Discretionary Investment Service: Our Investment Approach

With our Optimum range, all our portfolios are actively managed, meaning we are hands-on in making investment decisions on your behalf. Our unique approach relies on three building

blocks:

- Active Security Selection: We integrate quantitative screening with qualitative analysis. This allows us to leverage Cantor Fitzgerald’s global expertise in fixed income, alternatives, and direct equities, along with research from best-in-class external providers.

- Active Manager Selection: This consists of a rigorous process to identify experienced active managers that have a clear and identifiable edge in their chosen market, enabling them to deliver superior risk-adjusted returns.

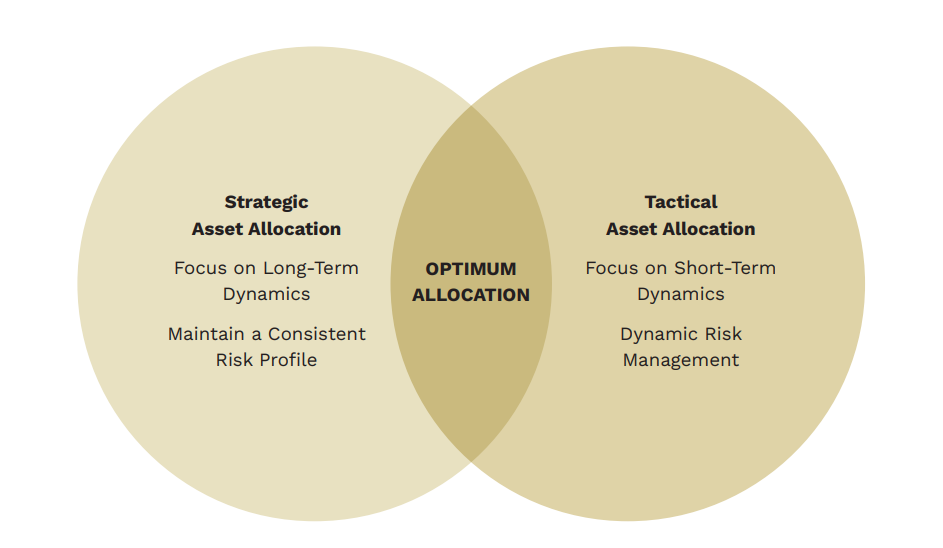

- Active Asset Allocation: This involves determining the appropriate distribution of your portfolio across various asset classes. By investing in our Optimum strategies, you benefit from both Strategic and Tactical Asset Allocation.

Investing is a journey, and we believe Strategic Asset Allocation is the guiding star to meet your long-term investment objectives. It reflects how much you should allocate to return-seeking and protection-seeking assets. We also believe, however, that a dynamic approach is crucial for long-term success.

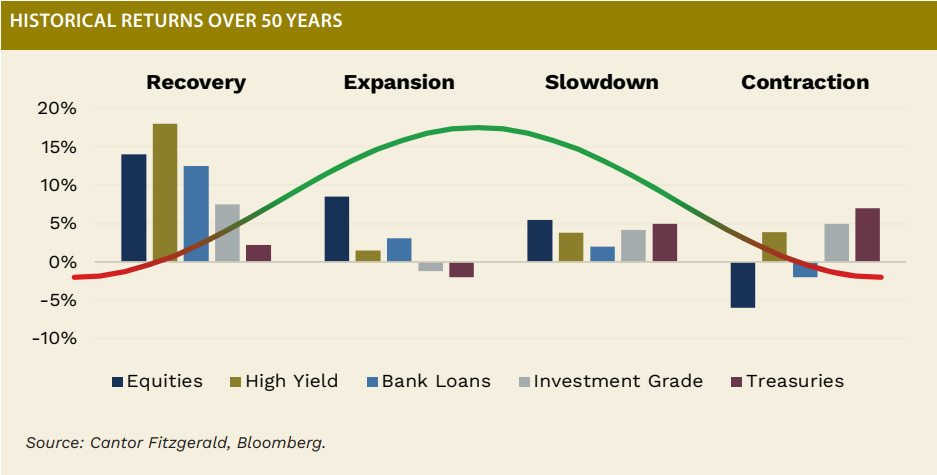

Each asset class performs differently depending on various factors, particularly on where we stand in the economic cycle. As you can see from the chart above, equities tend to outperform during the expansion and slow down phases of the economic cycle, while high=yield and government bonds generally outperform in the recovery and contraction phase, respectively.

As a result, we also employ Tactical Asset Allocation, which enables us to be nimble and take advantage of short-term deviations in longer-term market trends. With our Optimum Strategy, our goal is to construct portfolios that strike the optimal balance between maximising returns whilst managing risk. We are confident that this can be accomplished through effective diversification across asset classes, as well as within each individual asset class.

Leonardo Mazza

Leonardo Mazza