Constructive On Risk Assets In Q4, But Diversification Is Increasingly Key

The third quarter of 2025 demonstrated the value of staying invested. Despite volatility in financial markets, all the major asset classes, including stocks, bonds and commodities, generated positive returns over the quarter. This strength was driven by continued optimism about the transformative impact of AI, an easing of global trade tensions, and growing expectations for the commencement of a near-term rate-cutting cycle by the US Federal Reserve.

Whilst tariffs have contributed to a moderation in global growth expectations, the overall impact has been better than feared. Household and corporate balance sheets remain in good shape, and earnings momentum is solid, resulting in a constructive backdrop for equities. Within Asia, discounted relative valuations, corporate governance reforms and consumer-focused stimulus measures can act as a fillip for growth in the region.

Although ongoing US-China trade negotiations could lead to heightened market volatility, mutual interdependence means a deal is likely before year-end. Within Europe, the step-up seen in joint debt issuance can serve to advance much-needed reforms, which could unlock structurally higher growth while also boosting greater independence in areas such as defence and energy.

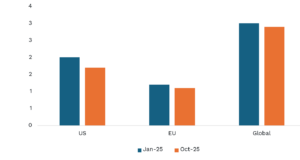

Tariffs impact on next year’s GDP growth rate estimates has been less than feared

Source: Bloomberg October 2025

In the United States, consumer spending has shifted down a gear, yet robust corporate investment in artificial intelligence has helped cushion the economy from a more pronounced deceleration in growth. AI has also propelled equity markets higher, driving valuations and earnings expectations to elevated levels in some segments. As a result, increasing focus on significant but less obvious beneficiaries of this transformative technology, which could boost G7 labour productivity by an estimated 1.3% over the next decade, may prove rewarding for equity investors.Furthermore, with fiscal and monetary policy turning more supportive, and with increasing deregulation, market conditions appear favourable heading into what is typically the strongest quarter of the year for US equities.

In fixed income markets, with the Federal Reserve increasingly focused on the employment component of its dual mandate, as much as 100 basis points of rate cuts could be in play over the next 12 months. This policy shift may provide a tailwind for US sovereign short-term debt relative to Europe.

Meanwhile, ongoing concerns over fiscal sustainability, particularly in the UK and France, coupled with emerging pockets of weakness in private credit, highlight the importance of security selection within fixed income. In this context, incorporating less correlated assets such as precious metals and infrastructure can enhance diversification and resilience within balanced portfolios.

Low correlations can see alternatives bring benefits to a balanced portfolio

Source: Bloomberg October 2025

Overall, with global growth remaining resilient, we maintain a constructive outlook for financial markets into the final quarter of 2025. However, ongoing geopolitical volatility and elevated market concentration underscore the importance for investors of actively diversifying their portfolios to effectively manage risks and seize opportunities.

Written by John Mullane, CIO, Cantor Fitzgerald Ireland

John Mullane

John Mullane