Analyst Conviction List: FBD Insurance

In April 2024, we added FBD to our Analyst Conviction List. We expect both positive capital gain returns, as well as substantial dividend income returns in the coming years.

FBD Holdings plc was established in the 1960s by farmers for farmers. It has grown from its roots in the agricultural industry to become a leading general insurer in Ireland. FBD serves customers throughout Ireland, with an entrenched position in the Irish non-life insurance market, especially within its farmer base, where it commands over 70% market share. More broadly, it enjoys excellent retention levels of over 90% with its farmer and business customers.

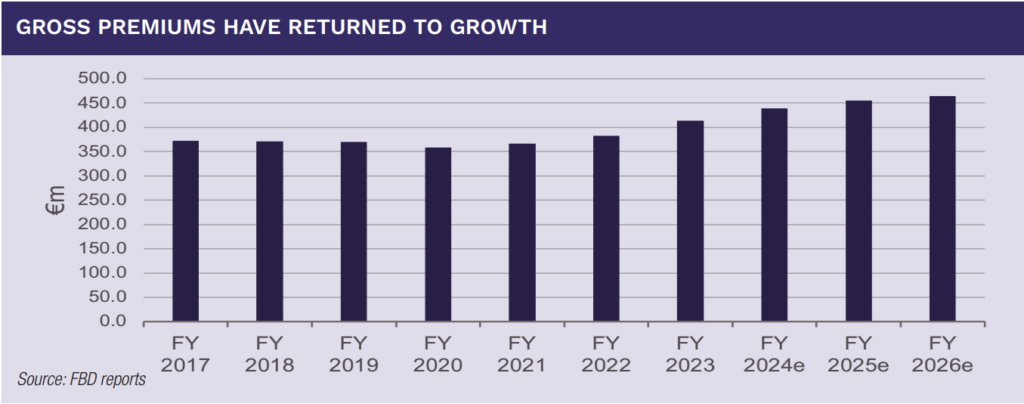

For the 10-year period to 2020, following the financial crisis and increased competition from AXA and others, FBD’s revenues only grew 2.7% cumulatively, however, since 2020 revenues have grown 15% and are expected to continue to grow mid-single digits in the coming years, supported by a more rational pricing environment.

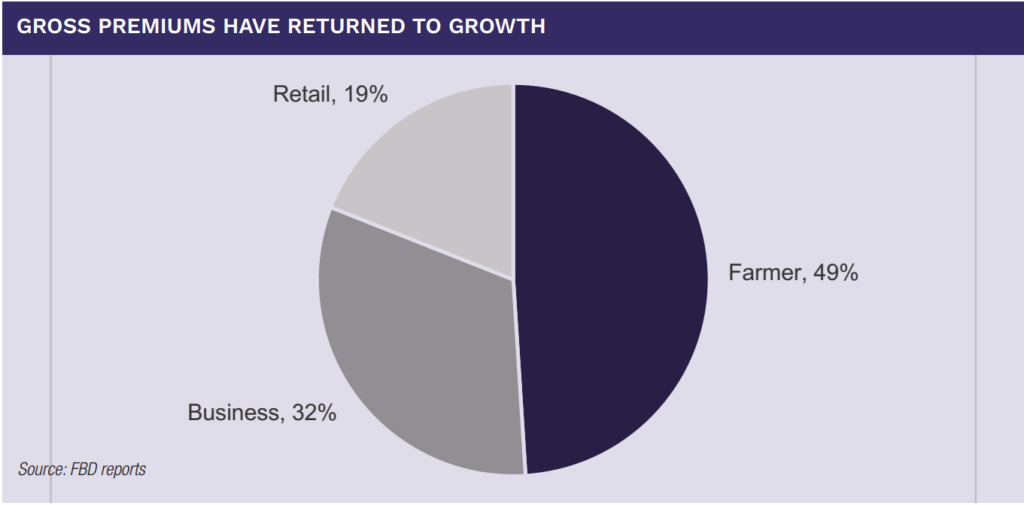

FBD’s customer and premium categories are well diversified across Farmer (49% of premiums), Business (32%) and Retail (19%), as well as Motor, including tractor (46%) and Non-Motor (54%). After retrenching following over-expansion into the indirect broker channel, FBD is growing again, with a focus on its direct approach to its core three customer groups, using data-empowered sales staff, and providing an entrenched local service to the farming and small/mid-sized business communities across Ireland. This is achieved through its network of 34 branches nationwide.

After several years of improving income in the agricultural sector in Ireland, 2023 was a more difficult year with incomes falling due to falling milk and crop prices, combined with poor crop yields. However, the aggregate level of farm operating income remains in line with the long-term growth trend since the 1990s, and Teagasc predicts rising incomes again in 2024. Importantly, given the increased cost of living, the Government’s CAP Strategic Plan includes a redistribution mechanism to direct payments from larger to smaller/medium-sized farms. It will redistribute 10% of the direct payments budget to farms with 30 hectares or less. This is expected to benefit the majority (75%) of farmers. The Irish Department of Agriculture, Food and the Marine (DAFM) anticipates continued growth in the agri-food sector, which is a crucial component of Ireland’s economy. The sector is expected to maintain its position as Ireland’s largest indigenous industry, contributing significantly to exports and rural employment.

Reflecting this view on farm incomes and the wider view on the Irish economy, management continues to see growth in Gross Written Premium (GWP), which has increased by approximately 9% YoY for the first quarter of 2024, ahead of our expectations at 5% for the full year.

Furthermore, the operating environment continues to be stable, with sound underwriting profitability, despite continued property and motor damage claims cost inflation. The Supreme Court’s recent decision to uphold personal injury award guidelines provides more certainty and reinforces FBD’s assumptions about the new regime reducing injury claims costs.

Investment returns continue to improve from higher income on reinvestment of maturing bond portfolios reflecting the higher ECB rate environment, as well as from higher equity markets.

Reported underwriting profit, and thus net income and EPS, are expected to be lower in 2024 due to the non-recurrence of a release of €44.4m in claims reserves, dating from the Covid period.

More importantly, FBD Holdings is overcapitalised with a solvency ratio of 213%, a target range of 150-170%, and annual free cash flow generation expected to be greater than €70m. FBD management is committed to returning excess capital to shareholders. It paid a €36m special dividend in October 2023, and the CEO signalled they are considering a similar special dividend in 2024, given the insurer’s €120m surplus capital position at the end of 2023. This is on top of maintaining its ordinary annual dividend of €1 per share. Buybacks are unlikely given the already concentrated shareholder registry, where the related parties, Farmer Business Development PLC and FBD Trust Company Limited, have combined control of 42% of the voting rights.

In summary, FBD’s strong 2023 performance, growth trajectory, dominant market position, and shareholder-friendly capital return plans make a compelling investment case. However, investors should remain alert to the impacts of claims inflation and weather events on profitability. We value the stock based on the average of 12x PE and 1.2x P/B, based on peer multiples and average ROE of 12% (’22-’25e) which generates a target price of €16 with approximately 21% price upside, before the potential 14%+ (regular plus special) dividend yield in 2024 and possibly 2025.

Peter de Lacey

Peter de Lacey