Why An Active Approach is Key Given Geopolitical Uncertainties.

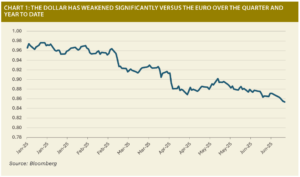

Global equity markets made gains over the second quarter despite having to navigate significant volatility primarily due to a sharp escalation and subsequent de-escalation of trade tensions. A temporary reprieve from US ‘Liberation Day’ tariffs and commencement of trade negotiations enabled markets to climb the wall of worry despite an escalation in Middle Eastern conflicts. International equities continued to outperform despite a sharp rebound in US tech, whilst weakness in the US dollar, which has suffered its worst start to the year since the end of the gold-backed Bretton Woods system, weighed on returns for Euro-based investors.

Outlook

The outlook for global equities remains relatively benign, notwithstanding expectations of a more moderate pace of growth, the global economy remains structurally sound, and the earnings outlook is supportive. In the US, earnings are set to grow for their eighth consecutive quarter, whilst a favourable regulatory backdrop, successful passage of a stimulative tax bill and an AI-related capex boom should result in plenty of tactical opportunities despite elevated headline valuations. Ongoing tariff uncertainty clearly poses risks to the outlook, however with negotiations well advanced and the US administration hoping for broad outline agreements to be in place for Labor Day, peak policy uncertainty should be in the rear-view mirror in the coming months. This in turn should provide greater confidence to corporates and consumers in the US, but also further afield. In Europe, whilst a 15% baseline tariff rate is a headwind, resilient domestic demand, easing inflation, lower borrowing and energy costs can lay the foundations for continued growth. Furthermore, higher government spending tied to Germany’s relaxation of fiscal spending rules and EU defence initiatives should act as a gradual fillip to growth in the quarters ahead. Within Asia, an agreement between the US and China on rare earths is a step in the right direction, however meaningful domestic stimulus will need to be forthcoming if 30% effective tariff rates are to remain in situ.

In fixed income markets, concerns on sovereign debt sustainability have resulted in investors looking for increased compensation to invest in longer-dated debt. This in turn highlights the importance of taking an active approach in fixed income whereby allocating to the intermediate part of the curve can enable investors to capture most of the yield on offer without being over-exposed to rising term premia. Alternatives such as infrastructure can also be used to generate income whilst offering attractive capital returns through exposure to secular growth themes such as digital transformation and the energy transition. Overall, whilst we remain constructive on the outlook for the second half of 2025, financial markets are likely to remain choppy as geopolitical noise remains elevated. Those investors that tune out the noise and stay well diversified will be best placed to navigate the challenges and capitalise on the opportunities that could be on offer in the months ahead.

Written by John Mullane, CIO, Cantor Fitzgerald Ireland

John Mullane

John Mullane