Cantor Fitzgerald Asset Management (CFAM) is Ireland’s number one performing pension and investment fund manager since inception¹.

Our three flagship multi-asset funds proudly hold a 5-star Morningstar rating, reserved for the top 10% of comparable funds globally. Established in 1986 and acquired by Cantor Fitzgerald Ireland in 2018, the CFAM team brings an exceptional track record in multi-asset investing dating back to 1993.

Time flies. It is now almost two years since we celebrated the 30-year anniversary of the CFAM 70 Fund, and ten years since we launched its lower-risk counterparts, the CFAM 30 and CFAM 50 Funds.

The CFAM 70 Fund has delivered consistently strong returns for our clients, combining asset security with relatively low volatility. A 10.5% annualised return since inception, and an average six-year return of over 8%. What more could investors ask for?

Why Launch Lower-Risk Versions?

We recognised a clear demand for lower-risk funds, driven by factors such as age, investment goals and individual risk tolerance. The significant growth of the ARF (Approved Retirement Fund) market was also a key consideration. Many investors now choose to invest their pension pots throughout retirement rather than purchasing an annuity, often seeking lower volatility as a result. We believed lower-risk versions of the highly successful CFAM 70 Fund would offer substantial benefits to this growing cohort.

The CFAM 70 Fund sits firmly in the “medium-high” risk category, which does not suit every investor. There is clear demand for options within the “medium” and “medium-low” risk brackets. I appreciate this even more myself, ten years on.

Additionally, we didn’t want to simply launch new funds without a significant cornerstone on which we could rely and to which we could attest the likelihood of success. Fortunately, we had one – a multi-asset fund which had (back then) a more than 20-year track record, driven by a consistent and proven investment process.

Three-Pillar Investment Process – Finding (in)Consistencies

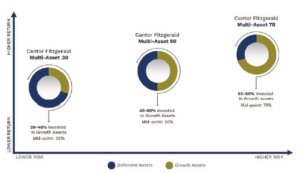

Our investment team has always managed the CFAM 70 Fund within a 60 to 80% growth asset allocation. This provided a reliable template for creating lower-risk versions, allowing us to model historical performance based on actual asset positioning and returns.

This back-test could not be distorted by hindsight. It was grounded in the real-world output of our investment process, giving us full confidence in its validity.

We knew our growth asset allocation, our defensive asset allocation, and the breakdown between cash and bonds. All of these were shaped by active management. It was therefore a straightforward process to reduce the growth allocation and increase the defensive allocation, creating a realistic picture of how lower-risk versions of the fund would have performed.

We launched the CFAM 30 Fund with a 20 to 40% growth asset allocation, which we considered the minimum for any multi-asset investor. The CFAM 50 Fund, with a mid-range allocation, followed naturally.

Delivering Lower Risk and Lower Volatility

Establishing a cornerstone for these funds was essential. It gave us confidence that the methodology was sound, and that each fund would perform as expected relative to the CFAM 70 Fund. The results since the launch of the CFAM 30 and CFAM 50 funds on the 21st July 2015 reflect this:

- CFAM 70 Fund: ~109% total return

- CFAM 50 Fund: ~82% total return

- CFAM 30 Fund: ~54% total return

(All figures gross of AMC and net of other charges.)

These returns align with expectations, reflecting the differing risk profiles across the funds. For some investors, especially those looking to preserve capital, draw income or work toward near-term goals, lower volatility is important. For them it’s about having a smoother investment journey and a more predictable performance. Have we achieved this? The answer is yes.

Over the Past Ten Years

- Cash has returned around 4%, primarily in the last three years, with no volatility

- Bonds with outperformance from our active management, have delivered modest returns, but volatility has been high in bond markets, close to 10% standard deviation

- Equities have been the primary source of return

The ten-year volatility for our funds:

- CFAM 30 Fund: ~7%

- CFAM 50 Fund: ~10%

- CFAM 70 Fund: ~13%

This reflects exactly what we intended. Lower returns are accompanied by lower volatility, the precise trade-off investors were seeking.

How Do Our Funds Compare to the Market?

The results speak for themselves, as shown below:

| Aug-25 | YTD | 1 Year | 3 Years p.a | 5 Years p.a. | 7 Years p.a. | |

| CFAM 70 | 7.3% | 15.5% | 17.2% | 11.5% | 11.0% | |

| Sector Average* | 1.4% | 7.3% | 9.3% | 9.1% | 7.5% | |

| MIM Rank | 1/8 | 1/8 | 1/8 | 1/8 | 1/8 | |

| CFAM 50 | 6.1% | 11.8% | 13.2% | 8.7% | 8.3% | |

| Sector Average* | 1.5% | 5.7% | 7.2% | 6.5% | 5.5% | |

| MIM Rank | 1/7 | 1/7 | 1/7 | 1/7 | 1/7 | |

| CFAM 30 | 4.5% | 7.9% | 9.0% | 5.5% | 5.5% | |

| Sector Average* | 1.9% | 4.3% | 4.8% | 3.6% | 3.2% | |

| MIM Rank | 1/7 | 1/7 | 1/7 | 1/7 | 1/7 |

*Equivalent Funds available in Irish market, L&G Multi-Index, Aviva ESG Active, ILIM MAPS & Consensus, New Ireland iFunds & Prime, Zurich Prisma. Returns gross of AMC.

Longboat Analytics & CFAM as of 31.08.2025

Looking Ahead

At Cantor Fitzgerald Asset Management, we remain committed to delivering market-leading returns for our clients through our active management approach and style-agnostic philosophy. We are proud of our track record and will continue striving to provide superior outcomes for investors across all risk profiles.

Written by Pearse MacManus, Cantor Fitzgerald Asset Management’s Director of Asset Management & Head of Fixed Income.

Pearse MacManus

Pearse MacManus