John Mullane, CIO Cantor Fitzgerald

This is a Marketing Communication.

The start of 2025 has brought plenty of surprises, most notably a significant outperformance of international equities relative to the US in the first quarter. This was prompted primarily by a relaxation of fiscal spending constraints in Germany, technological advancements by China’s DeepSeek combined with a more protectionist than expected trade policy stance in the US, which also saw the dollar lose some of its lustre and reverse its post-election gains.

Outlook

The imposition of more expansive tariffs (taxes on imports) by the US, than the market anticipated has served to cloud the global inflation and economic outlook, at least in the short run. These levies and their phased implementation leave room for negotiation, which could see tariffs being reduced or removed altogether. In the interim, equity markets are likely to remain volatile but with such volatility comes opportunity particularly within the US where a valuation reset will present an attractive entry point into several market-leading global franchises once the fog of policy uncertainty lifts. Within Asia, tariffs are clearly a headwind to what remains an export-orientated economy, however, strategic concessions combined with measures to boost domestic consumption, particularly within China, could serve to cushion the region’s economy from the worst of these trade restrictions. The swift implementation of President Trump’s ‘America First’ agenda has also served to galvanise European leaders into taking more decisive policy action, which will see greater investment, particularly in areas such as infrastructure and defence going forward. The impact of these investments is likely be unevenly felt; hence an active approach will be key to capitalise on the resultant opportunities.

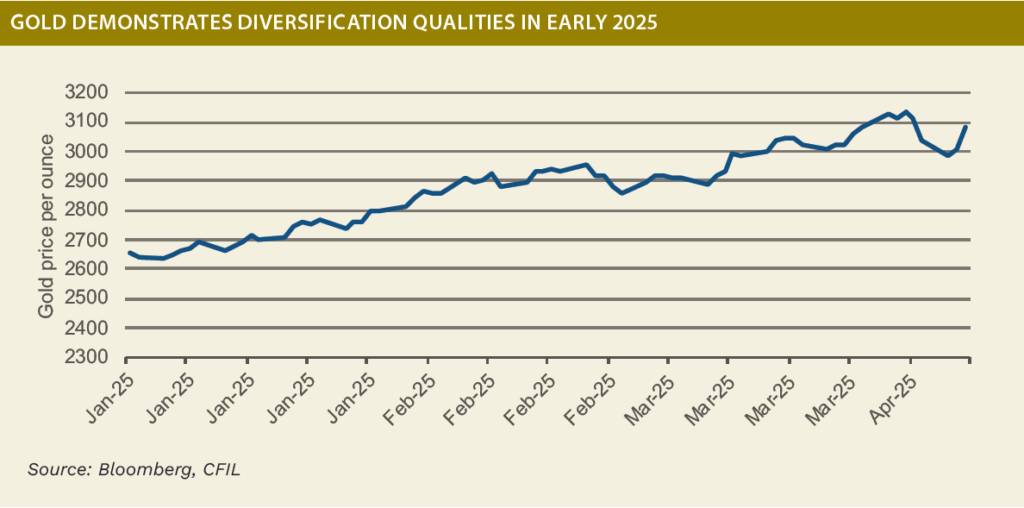

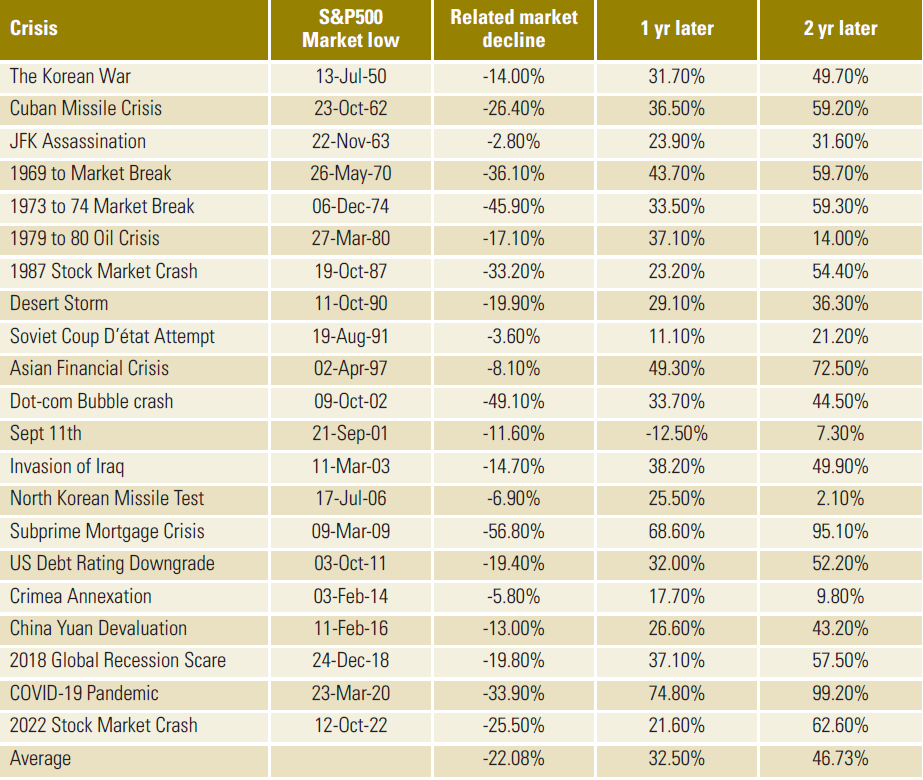

In fixed income markets, yields, whilst volatile, should trend lower on the back of growth concerns and the prospects of an acceleration in the pace of rate cuts in both Europe and the US. In fact, following two solid years of gains for equity markets, recent volatility serves as a timely reminder of the importance of having an allocation to risk protection assets such as high-quality bonds and gold, which can act as a ballast for investors’ portfolios in times of weaker growth and rising geopolitical volatility. Overall, whilst the current environment may feel uncomfortable as investors recalibrate to frequent shifts in US trade policy, it’s important to bear in mind financial markets have successfully navigated many significant economic disruptions in recent years.

Source: Bloomberg, CFIL

These have ranged from the outbreak of war in Ukraine to the COVID-19 pandemic – tariff disruption is likely to be no different. As a result, the best protection is to focus on the long term whilst remaining invested in a well-diversified portfolio, which contains the right mix of risk protection and risk-seeking assets to meet your unique financial goals.

John Mullane

John Mullane