Defending Europe, but at What Cost?

The world as we know it is changing rapidly. Reliable partnerships are being questioned. Europe has realised that it can no longer rely on America’s security umbrella and must now significantly increase its defence budget accordingly. Ireland is waking up to that new reality with a record €1.5bn defence commitment for 2025, and Tánaiste Simon Harris has spoken about possibly doubling that in the future to €3bn annually to include, amongst other things, expanded air and naval forces.

For investors, this generational shift in European defence is having major implications. The EU’s proposed €150bn defence fund and the broader €800bn “ReArm Europe” plan could trigger a wave of capital flow to sectors such as:

- Defence contractors, with increased demand for military tech, equipment, and logistics.

- Cybersecurity, as governments ramp up digital defence spending.

- Technology & R&D, with spillover effects into AI, automation, and aerospace innovation.

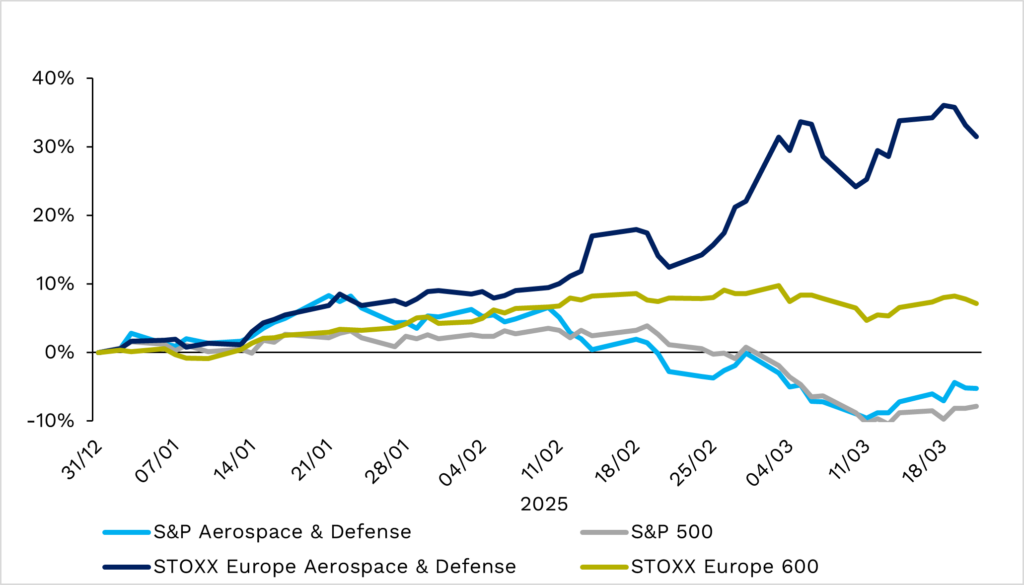

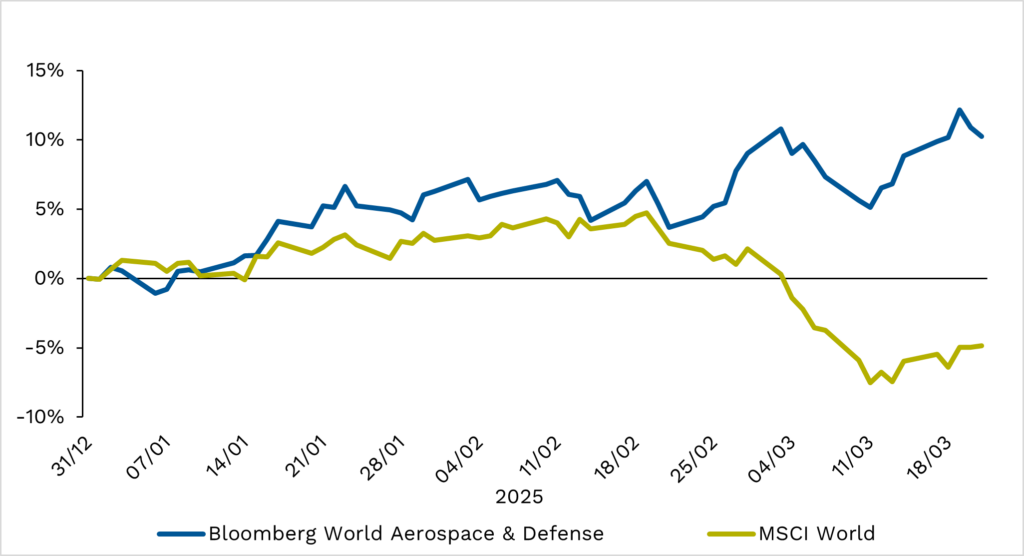

- YTD, companies seen as beneficiaries are leaving the broader market behind with the European defence sector +32%, and +40% vs the S&P 500.

Source: Bloomberg 2025

Whilst this spend is arguably well overdue and necessary, it also raises pertinent questions about the future spending that will be required to maintain an independent security policy, including potential tax increases and budget reallocations.

Financial Commitments and Potential Tax Implications

European leaders have acknowledged the substantial financial commitments required to enhance defence capabilities. Discussions have already highlighted the need for significant investments to elevate defence spending across Europe to 3.5% of GDP.

So how are we going to pay for all this? While joint borrowing has been considered to cover a portion of these expenses, the remainder would need to depend on national budgets, which are already under strain from high debt levels. If budget constraints slow down planned spending, some of these gains could be priced in prematurely. But for now, the markets are positioning for a long-term shift in flow of capital to defence.

Conclusion

The establishment of a European Defence Union represents a strategic endeavour to strengthen Europe’s security framework. For investors, the focus is on who benefits, who pays, and where the risks lie. If you’re thinking about how to position your investments for this, or want to discuss market implications, please get in touch.

James Stafford, Portfolio Manager Associate, CFIL

This is a Marketing Communication

#Defence #EuropeanDefence #DefenceIndustry #ThisIsAMarketingCommunication #CantorFitzgerald

James Stafford

James Stafford