World Economic Growth Holding Up

This is marketing material.

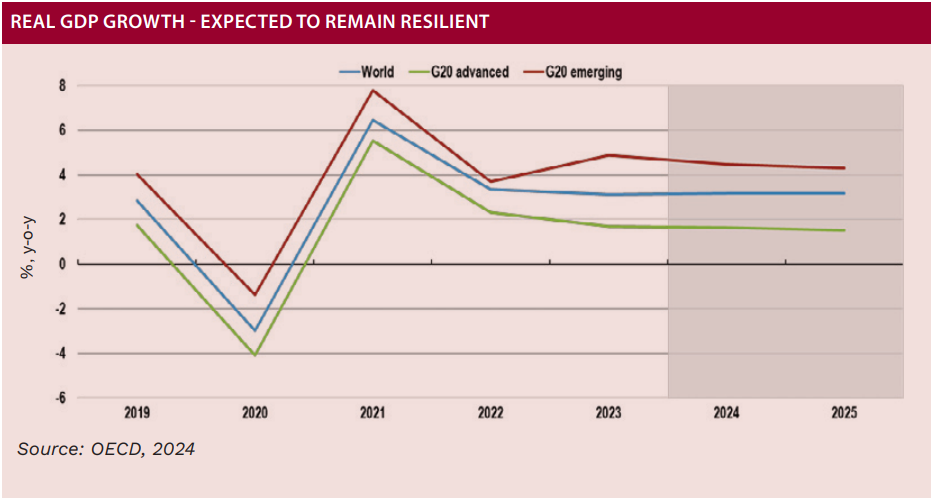

Services Sector Performing Better Than Manufacturing

The outlook for the world economy is one of stable growth helped by easing inflation and resilient global trade. The latest business surveys point to stronger activity in services rather than in manufacturing sectors. Consumer confidence has picked up but remains subdued relative to long-term trends. The OECD is currently predicting average real GDP growth for the world as a whole of between 3.0% and 3.5% in both 2024 and 2025. The US remains in better shape than the Eurozone and UK, and is likely to continue to outpace European growth in the short-term at least. Despite the positive overall forecasts, risks remain to the global outlook, particularly on the geopolitical front. The worsening of the conflict in the Middle East has the potential for a negative impact both on growth and inflation, particularly in relation to energy prices, and the European Union cannot afford to dismiss the rise in support for far-right parties across the bloc. The world fiscal outlook too remains a cause for concern as rising debt and interest payments are likely to hinder growth efforts going forward and leave countries ill-prepared for future crises, including climate-related issues and technological shifts.

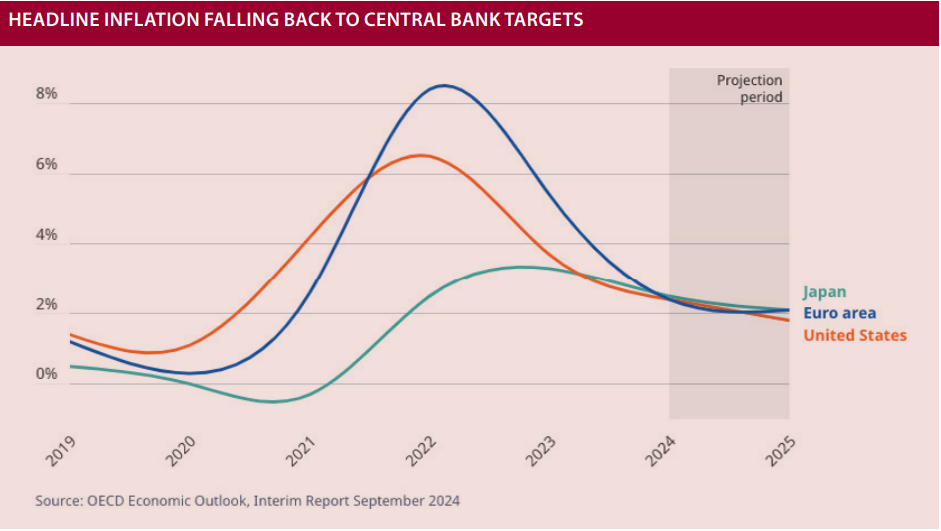

Headline Inflation Continuing to Decline

Headline inflation has continued to decline in most OECD countries this year, partly due to further falls in food price inflation and lower energy and goods price costs. As a result, inflation is now at or close to target in about four-fifths of OECD economies. However, services price inflation remains sticky and has abated only slowly. Indeed, it is set to remain elevated for a while yet. Labour market pressures have also continued to ease, which should in time bring down wage costs. The number of job vacancies has steadily dropped from the peak levels observed during the pandemic. Unemployment has risen since the beginning of 2024 in a number of key countries, including the United States. The easing of inflation and labour market pressures has allowed the world’s major central banks like the Fed and the ECB to begin cutting interest rates. More reductions are likely over the next twelve months or so notwithstanding current geopolitical risks. Still, the timing and scope of further policy rate reductions will need to remain data-dependent and be carefully judged to ensure that underlying inflationary pressures are well contained.

All Eyes on US Presidential Election

Aside from the ongoing conflict in the Middle East, the main event of interest between now and year-end will be the outcome of the US Presidential election on November 5. And it’s anybody’s guess how this will go. Back in the early Summer it seemed like a foregone conclusion that Republican candidate Donald Trump would get back into the White House after his failed attempt for a second term in 2020. However, the landscape has changed substantially since then, as President Joe Biden’s decision not to run for re-election and instead endorse his Vice President has seen Kamala Harris narrow the gap and indeed even overtake Trump according to some opinion polls. From a financial market perspective, it is difficult to know which outcome would be better in the long-run. Trump is viewed as a proponent of deregulation and lower taxes (both seen as positive in the near-term) but he is also known for his unpredictable nature and fondness of imposing trade tariffs (both seen as negative). If elected, Harris is likely to raise taxes and has committed to stick to Biden’s proposal to increase corporation tax to 28% from 21%, whereas Trump proposes cutting it to 15%. A change in the corporation tax rate either way, could have serious implications for Ireland and foreign-direct investment in the country. Clearly, a victory for Harris would be a better outcome for the Emerald Isle from that perspective. As things currently stand, Harris has every chance of becoming the first female President of the United States, but you write Trump off at your peril. It may well come down as it quite often does to the economy, stupid. Biden and Harris were in office when the cost of living crisis took off, one which has plagued US consumers in recent years and continues to do so, and that could be Trump’s best hope, especially among voters who remain undecided at this stage. Whatever the outcome of the election, it will have a profound impact on the world economic and political landscape.

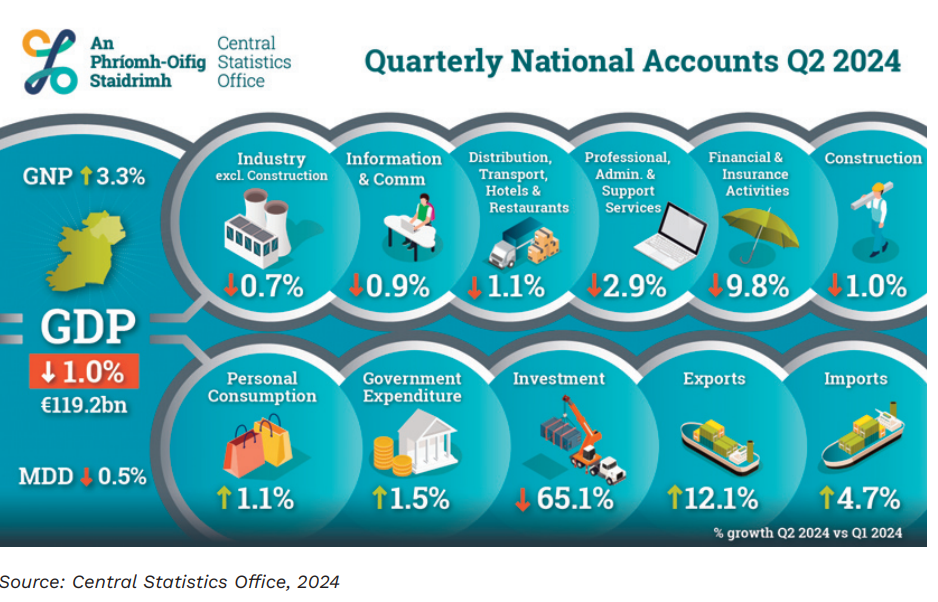

Irish Economy Set to Contract in GDP Terms Again This Year

The most recent figures from the Central Statistics Office (CSO) suggest that the Irish economy will, in GDP terms, contract for the second year running in 2024. Following a drop of 5.5% last year, a decline of around 4.0% looks on the cards this year. However, modified domestic demand, which gives a better indication of what is going on economically in underlying terms (that is when one strips out the multi-national element), is projected to rise by between 2.5% and 3.5% both this year and next. The expected drop in GDP in 2024 is mainly due to developments in the Information and Communications Sector relating to intellectual property. Employment growth and corporation taxes remain strong, which points to a healthy economy overall, but the over-reliance on corporation tax receipts from a small number of multi-nationals remains a cause for concern going forward. Another cause of worry is that the combination of strong domestic demand and supply constraints are now contributing to higher costs for domestically generated goods and services. Meanwhile, Budget 2025 delivered an overall package of €10.5bn made up of a package of once-off measures worth €2bn, total expenditure of €6.9bn and additional capital expenditure of €1.6bn. Permanent tax changes amounted to €1.4bn for next year. While the Budget largesse may guarantee some votes for the Government parties in the next General Election, which is now likely to take place this side of Christmas rather than early next year, it will only add to the domestic inflationary pressures at a time when many consumers are still finding it hard to make ends meet.

Alan McQuaid

Alan McQuaid