How an Alternative Approach Can Bring Greater Balance to Your Portfolio

Diversification is a cornerstone of investment strategy, aiming to reduce risk and enhance returns by spreading investments across various asset classes. Traditionally, bonds have been the go-to asset for diversifying equity-focused portfolios, offering stability and income generation. However, given the recently high correlation between bond and equities returns, this traditional diversification method has faltered in recent years. This article analyses the rationale behind the failure of traditional bond diversification and how the use of alternative investments can enhance portfolio diversification.

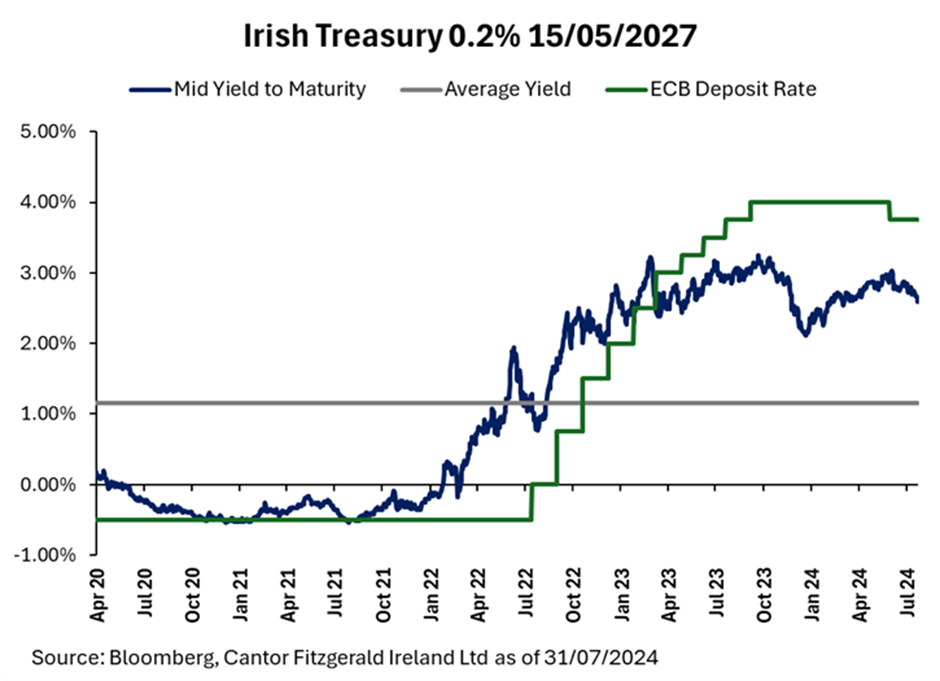

Having had low yields for over a decade in the Eurozone, and in some cases negative real yields, bonds are now attractive again from a fundamental point of view. As an example, the Irish Treasury Bond 0.2% 05/15/27 is now yielding circa 2.59% compared to an average of 1.16% since issuance. Higher yields also lead to potential higher capital gains, and Irish Treasuries are exempt from CGT which makes them even more attractive in a balanced portfolio, particularly for Irish domiciled investors. This exemption applies to Irish residents.

From a macroeconomic perspective, bond investments are highly sensitive to interest rate fluctuations. When interest rates rise, bond prices typically fall. This effect was particularly evident in 2022, especially for long-duration bonds, which were more vulnerable to interest rate increases. Conversely, when interest rates decline, bond prices generally rise, improving their attractiveness. For example, the European Central Bank’s decision to start cutting rates in June has made European treasuries more appealing, potentially enhancing their role as a stabilizing force in investment portfolios.

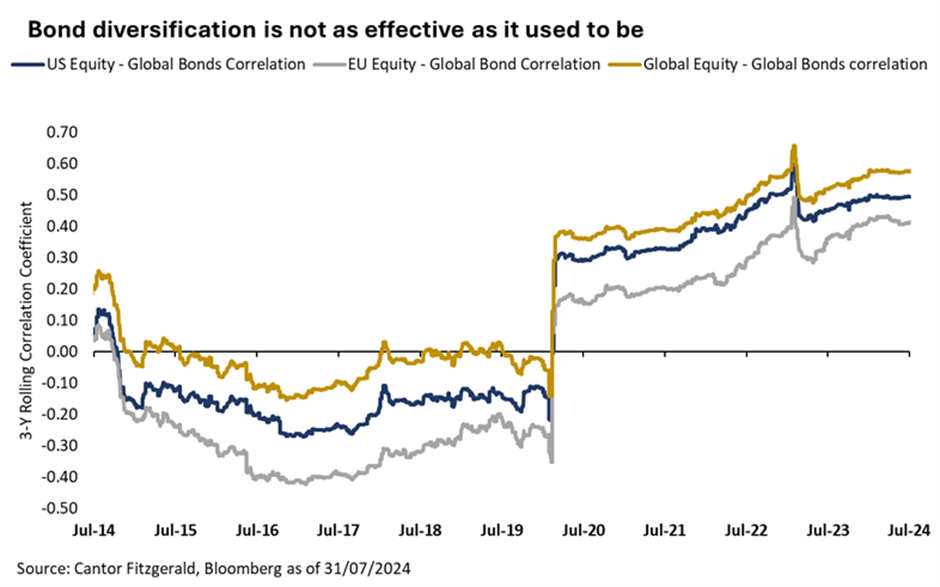

However, in certain economic conditions, bonds and equities can become highly correlated, meaning they move in tandem. This diminishes the effectiveness of diversification because it reduces the potential for risk mitigation. This was particularly evident during the Covid-19 outbreak in 2020.

When bonds and equities are highly correlated, their returns tend to move in the same direction simultaneously, leading to synchronised losses or gains. This correlation limits the ability of a diversified portfolio to cushion against market volatility, ultimately failing to protect investors from significant downturns and reducing the overall stability and performance of the investment strategy.

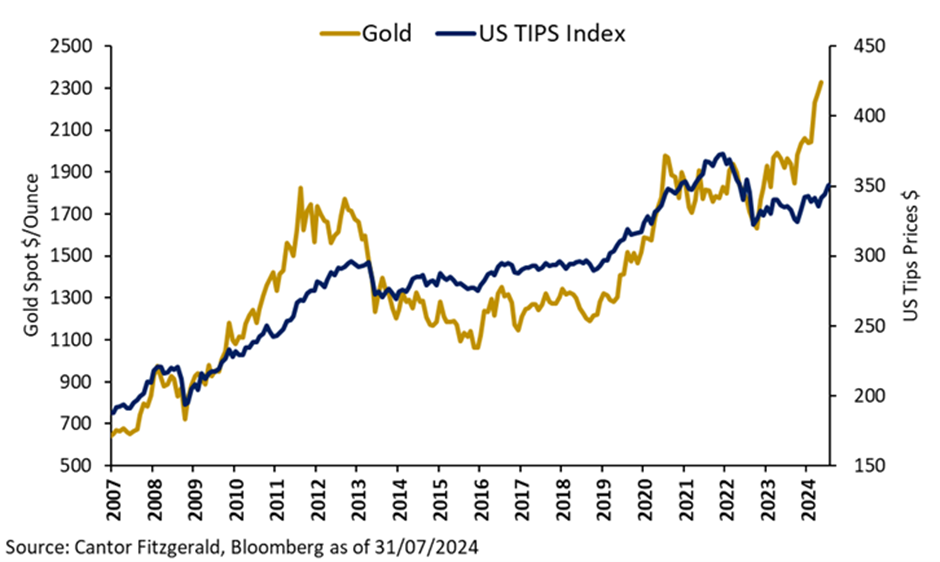

The failure of traditional diversification methods to provide adequate protection in a portfolio has prompted investors to seek alternative investments. One such alternative is gold, a timeless asset renowned for its ability to preserve value over time. Often referred to as a “safe haven” asset, gold offers a compelling option for enhancing diversification due to its low correlation with equity markets, meaning it often moves independently of these assets. This characteristic makes gold particularly effective in reducing overall portfolio risk. During periods of economic uncertainty, geopolitical tensions, or market stress, gold tends to appreciate as investors seek it out for safety. For instance, during the 2008 financial crisis, while the U.S. equity market fell by 37%, gold appreciated by 4%. This example underscores gold’s potential to stabilize portfolios in turbulent times, making it an attractive alternative for those looking to safeguard their investments against market volatility.

Gold is also an effective inflation hedge given the high correlation with Treasury Inflation Protected Securities (TIPS). Launched in 1997, TIPS are intended to safeguard investors from inflation, because the principal and interest payments of TIPS are adjusted based on fluctuations in the Consumer Price Index (CPI), while gold preserves value through its intrinsic worth.

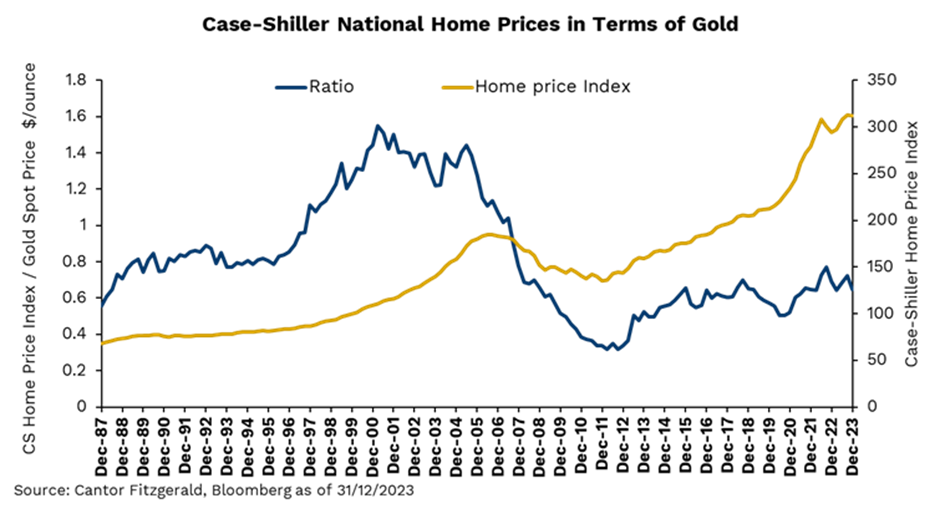

Moreover, gold has historically maintained its real estate purchasing power over long periods of time. Hence, the real estate to gold ratio is a tangible measure on home affordability in the United States.

Beyond traditional diversification assets, such as gold and bonds, alternative assets are becoming increasingly prominent in balanced and managed portfolios. “Alternative investing” serves as an umbrella term for non-traditional asset classes, including but not limited to private equity, infrastructure, and real estate funds. These liquid alternative investments provide opportunities for enhanced diversification, often offering uncorrelated returns compared to traditional asset classes, which can improve overall portfolio resilience and potential returns in varying market conditions.

Private equity investments, for example, can offer investors diversified portfolios with improved risk-adjusted performance. These types of investments typically exhibit lower volatility because they are not subject to the same market noise and fluctuations that publicly traded markets experience. As a result, private equity can provide a more stable, volatility-adjusted return, making it an attractive option for investors looking to enhance the resilience and performance of their portfolios. A key drawback to consider when investing in private equity is that many of these unlisted funds are illiquid and usually only redeemable or tradeable during limited periods unless one chooses to capture this exposure through listed alternatives. This illiquidity can impose significant restrictions on a portfolio, as it prevents the fund manager from readily adjusting the size allocation of the investment or redeeming it for cash.

Infrastructure investments such as roads, airports, ports, and railways, as well as utility assets often provide stable and predictable cash flows, lower volatility, and potential inflation protection. Infrastructure projects typically generate consistent income through long-term contracts or regulatory frameworks, offering stability while providing a natural hedge against rising prices given the nature of their business.

Real estate, one of the oldest forms of wealth protection, remains highly relevant today. Real estate funds enable investors to diversify across multiple properties, reducing the risk associated with vacancies and leading to more stable yields. As a result, real estate remains a robust option for those seeking to protect and grow their wealth in an evolving market landscape.

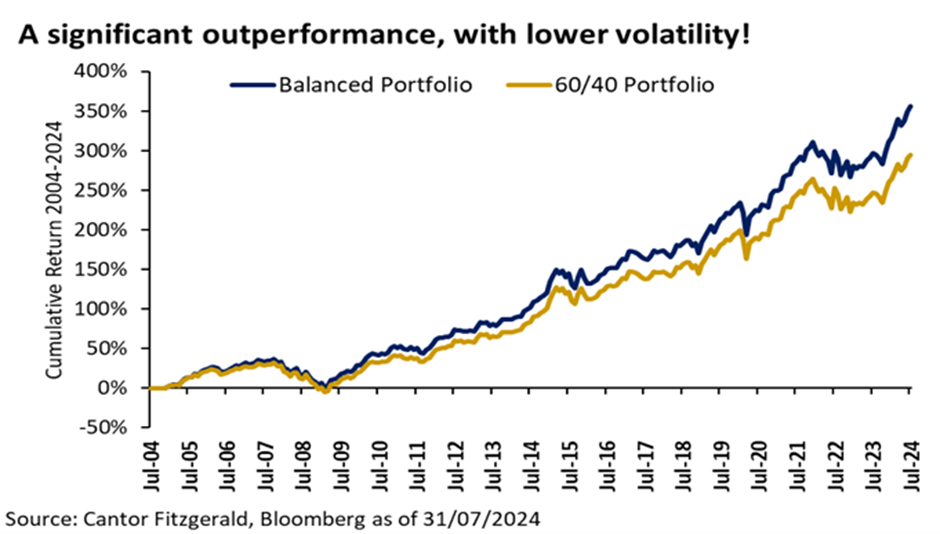

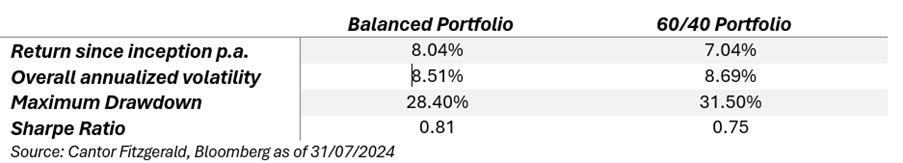

Incorporating alternative investments, can enhance the resilience and diversification of traditional portfolio, mitigating risks and capturing unique growth opportunities. The below chart shows the long-term return of a traditional 60/40 equity/bond portfolio, compared to a balanced portfolio that tactically allocates to alternative investments such as gold, real estate and infrastructure. In the data outlined below, 5-10% of the portfolio is tactically allocated to alternatives depending on market correlations, economic conditions and fundamental factors.

In the evolving landscape of investment diversification, alternative investments stand out as complementary to bonds, and potentially as an alternative during periods of market stress or increased cross-asset correlations. Their historical performance, low correlation with other assets, and ability to hedge against inflation and economic uncertainties make them an attractive addition to multi-asset portfolios.

A dynamic asset allocation approach is also crucial for long-term success, because each asset class performs differently depending on various factors, particularly where we stand in the economic cycle. As a result, it is crucial to employ tactical asset allocation to take advantage of short- term deviations in longer term market trends. By incorporating alternative assets, investors can potentially achieve a more resilient and well-rounded portfolio capable of weathering various market conditions.

This alternative approach should deliver a portfolio that strikes the optimal balance between maximising returns whilst managing risk.

This article was originally published in The FM Report.

Leonardo Mazza

Leonardo Mazza