Expansion of our Discretionary Investment Service: Q&A with CIO, John Mullane

We were delighted to announce the expansion of our Discretionary Investment Service in Q2 2024. To learn more about the expansion, Senior Portfolio Manager, Suzanne Berkery sat down with Chief Investment Officer, John Mullane who recently returned to the firm to explore key highlights of the updated offering.

Suzanne: Hi John. Tell us about the updated offering; who is the discretionary management service best suited to?

John: Hi Suzanne. This service is ideally suited to high-net-worth individuals, pension funds, charitable organisations, and institutional clients with a minimum investment capacity of €250K, who would like their portfolio actively managed but without the responsibility of the day-to-day decision making.

Suzanne: It sounds like an ideal option for those who want to invest, but who don’t have the time for daily check-ins. So, how does the discretionary management offering work if I decide to invest?

John: It’s quite an easy process; we do all the heavy lifting. A consultation will be arranged with an experienced relationship manager to identify and prioritise your financial goals and investment objectives including your tolerance for risk along with your knowledge and experience. Our team will analyse your current situation, determine the most suitable investment strategy, and explain how it should aid you in achieving your goals. If you decide to invest, you’ll have online access to portfolio valuations, receive quarterly updates on your portfolio’s performance along with regular market insights from the investment team.

Suzanne: What does the discretionary management offering look like? How does it cater to different peoples’ needs?

John: The six Optimum strategies are designed to suit people with a variety of different investment goals and tolerance for risk (including a dedicated ESG strategy and two highly CGT efficient offerings). Each strategy is constructed to target pre-defined risk levels and is managed in line with our six-step investment approach (detailed below). We invest across a range of asset classes while adopting a multi-strategy and multi-manager approach.

Suzanne: There’s a lot of similar offerings on the market, what’s different about this approach?

John: There are a few things that make our discretionary offering unique. Firstly, each investment strategy is managed through segregated accounts, so clients are owners of individual securities rather than just holding units in a conventional pooled fund. In addition to the tax advantages such an approach can potentially offer, we also aim to ensure each client gets a high touch personalised service from a dedicated relationship manager whilst also receiving regular updates from and engagement with the experienced investment team based in Dublin that are managing their assets.

Suzanne: How are you leveraging being part of a broader group through this strategy?

John: We aim to bring the firm’s global expertise in areas such as direct equities (where the firm covers 250 equities globally), fixed income and alternatives to bear on these strategies whilst also capitalising on the skills of our internal fund managers here in Dublin. We also aim to use the firm’s global reach to provide Irish investors with exposure to global investment managers with proven performance, particularly in markets where dispersion of returns is high.

Suzanne: That’s another big benefit for those who decide to invest. Back to the offering, can you explain how the investment approach works and how it is monitored?

John: Clearly, the primary objective of these strategies is to preserve and grow the real value of our clients’ wealth over time. As a result, we take a long-term approach to investing, with a bias to staying invested through the cycle. Our active investment approach combines a top-down macro-overlay, which informs us as to what geographies, sectors, and styles we should be under or overweight on. This is combined with bottom-up security selection. The fund management team will make the day-to-day active portfolio decisions whilst the strategies’ Global Investment Council will bring a wealth of investment experience (including former CFIL CIO David Beaton and the CIO of Cantor Fitzgerald Investment Advisors in the US, Herb Morgan) in validating the robustness of the process.

Suzanne: That sounds like a very thorough approach. How are portfolios constructed and risks managed?

John: Indeed. Our goal is to construct portfolios that are efficient, achieving the optimal return for a given level of risk, which is achieved through effective diversification. Each strategy consists of a differing mix of Return Seeking (e.g. Stocks and Private Equity) along with Protection Seeking Assets (e.g. Bonds and Infrastructure) depending on the client’s risk profile. In addition, as markets are not frozen in time and risk exposures keep changing, our process incorporates a robust risk management approach.

Suzanne: Great. I’ll close out with a basic but very important question; why should I invest now, and with Cantor Fitzgerald?

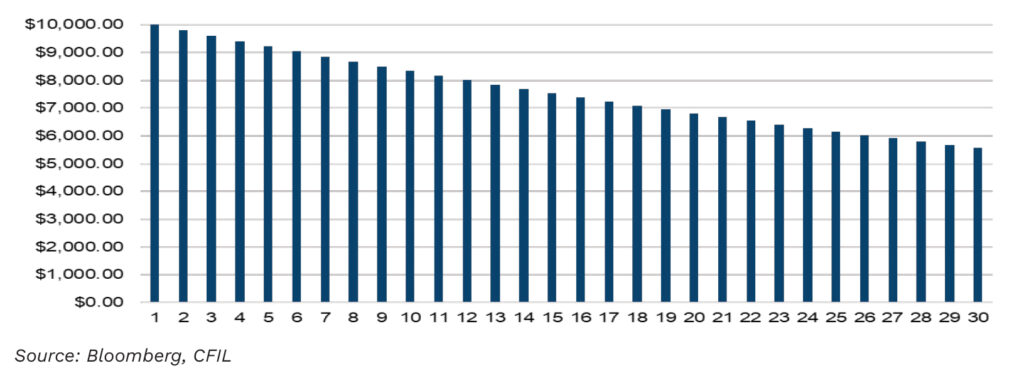

John: If you’re considering investing, this offering may be what you have been looking for. We believe for investors it’s important to partner with a provider that will aim to ensure they have the correct mix of return/protection seeking assets to achieve their financial goals rather than having a benchmark allocation to cash, the real value of which can erode over time due to inflation. With our international expertise as a premier global financial services firm combined with our local knowledge, having served clients in the Irish market for close to 30 years, we believe we can be that partner.

EFFECT OF 2% INFLATION ON THE PURCHASING POWER OF $10,000

If you’d like to learn more about the Discretionary Investment Service, please reach out to a member of our team.

John Mullane

John Mullane