2026 Looks Promising, But Geopolitical Volatility Underscores The Importance Of Thoughtful Diversification

With Irish newspaper headlines dominated by concerns on the implications of global trade tensions and two conflicts on Europe’s doorstep, 2025 was often an uncomfortable one for investors. Yet last year underscored the importance of remaining invested in a diversified portfolio, as despite bouts of significant volatility, both equities and commodities delivered positive returns on the year, with only a modest drag from bonds. Market strength was driven by optimism surrounding the transformative potential of AI, supportive monetary policy and continued expansion in global trade, even in the face of the highest U.S. tariff rates in a century.

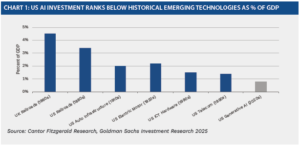

With global economic growth set to remain close to 3.0%, corporate earnings to expand in the low double digits, and fiscal policy broadly supportive, the backdrop remains constructive for risk assets heading into 2026. Within the U.S., economic activity is set to moderate; however, it should remain above its long-term trend rate, whilst the trifecta of pro-cyclical monetary and fiscal policy, combined with deregulation, should act as a tailwind for equities. AI is expected to remain a key driver of market sentiment, and whilst capital investment is low relative to previous transformational investment cycles, investors will be increasingly focused on profit over potential. Market leadership should also broaden beyond the enablers to AI beneficiaries in 2026.

Across Asia and Emerging Markets (EM) the divergence that characterised 2025 looks set to continue. EM has regained momentum after years of underperformance, with a weaker USD combined with favourable macro and commodity cycles presenting a supportive backdrop. In China, AI innovation gains should support the continued growth of domestic tech, where valuations remain attractive. A broader market rebound, however, will likely require greater progress on reducing tariff-related uncertainty, along with meaningful delivery on measures to boost domestic demand, a key priority of the Politburo in China’s Year of the Horse.

Closer to home, Europe should continue to generate solid yet uninspiring levels of economic growth. With consumer sentiment remaining subdued and the ECB likely holding steady, continued expansion in global trade and increased fiscal spending should be the key growth tailwinds in 2026. In particular, the fiscal impulse from Germany’s planned investment of €500bn in infrastructure and defence should be a positive over the course of the year; however, its impact is likely to be unevenly felt, reinforcing the importance of an active approach.

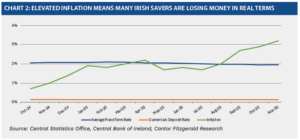

At today’s yields, high-quality bonds look an increasingly attractive alternative to cash on deposit for savers, particularly when one considers that Irish inflation is running at over 3.0%. Disciplined credit selection will remain more important than ever, given rising fiscal deficits in many developed markets and pockets of weakness in private credit. Alternatives can also complement Fixed Income by enhancing portfolio diversification and returns.

Overall, notwithstanding pockets of overvaluation, with economic and corporate earnings growth set to be robust and the full productivity benefits of AI still to come, investors should be cautiously optimistic on the outlook for 2026. The new year also represents a great opportunity for investors to review their financial plan to ensure their assets are working hard to beat inflation by capitalising on the opportunities across financial markets.

Written by John Mullane, CIO, Cantor Fitzgerald Ireland

John Mullane

John Mullane