What is Sustainability?

In 1987, the United Nations defined sustainability as “meeting the needs of the present without compromising the ability of future generations to meet their own needs”. Sustainability is about the prudent use of resources, with a view to long-term priorities and consequences of the ways in which resources are used.

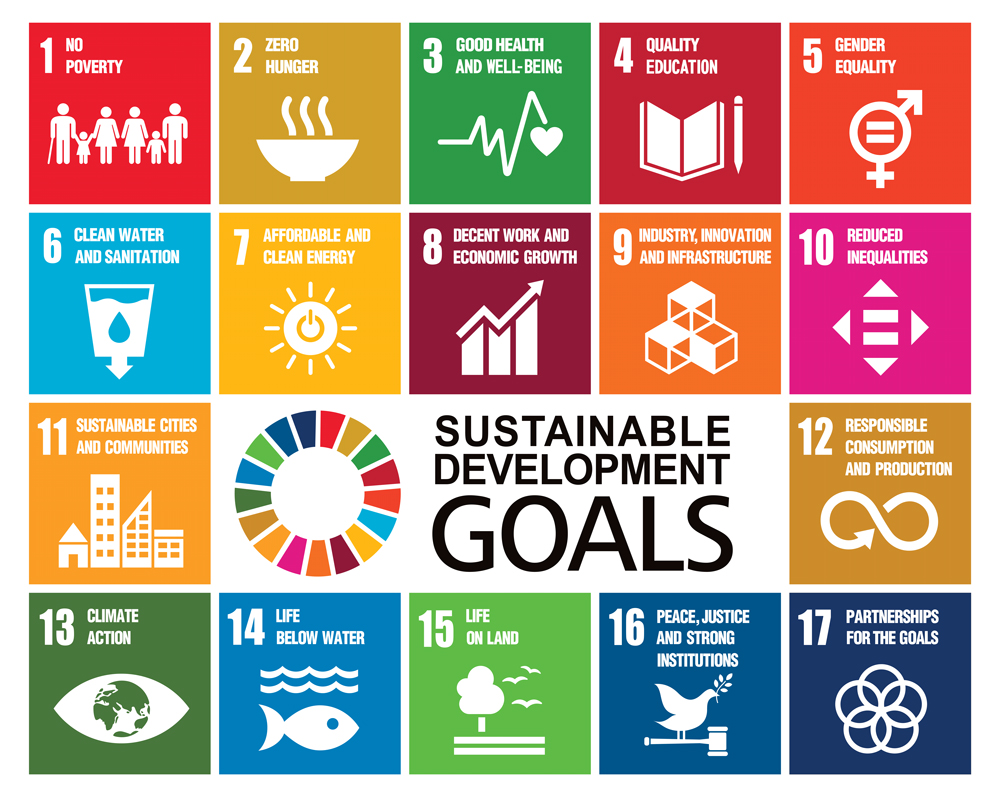

Sustainable Development Goals (SDGs)

The SDGs are a collection of 17 interlinked global goals agreed as an international framework of reference that addresses the most pressing challenges of sustainable development. Investors may use the SDGs as a framework of reference for areas of impact when it comes to addressing sustainability in their portfolios.

Sustainability Preferences

Recent changes to the Market in Financial Instruments Directive (MiFID II) now require investment advisors and investment managers to ask investors whether they would like to see aspects of sustainability reflected in their investment decisions. This is known as the collection of sustainability preferences and has become part of the regular suitability assessment process.

Your Preferences Explained

Head of Sustainability at Cantor Fitzgerald Ireland, Carolina Angarita-Cala explains more about sustainability preferences, how individual and institutional investors can articulate their environmental, social, and governance (ESG) priorities and how these preferences align portfolios with sustainability goals.

What is the Suitability Assessment?

The assessment of suitability is a core investor protection measure under MiFID II. Correctly assessing client suitability ensures clients are only invested in products and services that are suitable for their own needs and objectives. The goal of suitability rules is to ensure clients best interests are at the forefront of investment decisions. The assessment of suitability is applicable to both advisory and discretionary clients.

Suitability rules require investment firms to gather relevant information from clients in relation to:

- investment objectives, including risk tolerance

- financial circumstances including ability to bear loss

- knowledge and experience

- investment time horizon

- personal circumstances

- sustainability preferences

Collection of this information enables the Firm to complete a suitability assessment and (in the case of advice) provide suitable personal recommendations to clients or (in the case of discretionary clients) to make suitable investment decisions on behalf of the client(s).

In relation to sustainability preferences, clients must be asked the following:

- Whether the client has sustainability preferences (yes/no)

- The minimum proportion which the client wishes to invest in environmentally sustainable investments and sustainable investments

- The Principal Adverse Impacts which the client wishes to be considered.

CFIL will request information to assess a client’s sustainability preferences to enable it to match the client with suitable products. Terms and concepts used when referring to environmental, social and governance aspects will be explained to clients. This will include an explanation of the differences between products with and without sustainability features in a clear manner, avoiding technical language. This regulation came into force in August 2022. Questions relating to sustainability are required as part of the suitability assessment and must be asked to every new client of the firm and every existing client where a suitability review is taking place.

Sustainability Preferences Are Grouped in Three Major Themes

Environmentally Sustainable Investments or “Taxonomy-Aligned”

These are investments in economic activities that make a significant contribution to an environmental objective based on technical screening criteria.

Sustainable Investment

This is a more all-encompassing description of both environmentally and socially sustainable investments. The Sustainable Finance Disclosure Regulation (SFDR) is the regulatory regime governing the definition of sustainable investment (SI).

Principle Adverse Impact (PAIs)

Principle Adverse Impact indicators are a collection of data points where investments can be screened to highlight their sustainability risks against one another. They cover environmental, social and governance metrics (ESG risks).