Celebrating Three Decades of Excellence

Cantor Fitzgerald Asset Management’s Flagship Multi-Asset 70 Fund Marks its 30th Anniversary.

Cantor Fitzgerald Asset Management (CFAM) is Ireland’s Number 1 performing pension and investment fund manager in the Irish market since its inception1. Our trio of core multi-asset funds boast a 5-star rating on Morningstar, which is preserved for the top 10% of similar funds rated on a global level. Established in 1986 and acquired by Cantor Fitzgerald Ireland in 2018, our team has a strong track record in multi-asset investing dating back to 1993.

We have delivered consistent and exceptionally strong performance for our clients over the years whilst offering both security of assets and returns with relatively low volatility. CFAM has more than thirty years’ experience of managing investment portfolios for a range of clients, including religious orders, private and corporate pension schemes, life companies, semi-state companies, charities, high net worth individuals and retail clients. Currently, we manage assets in excess of 1.7 billion euros.

Investment Process/ Philosophy

Our approach to investment stands apart from traditional investment management structures and processes, which are typically organised around asset classes and regional markets. Our unique investment process, based around the three key pillars of macro-economic, technical and valuation analysis, has been extremely rewarding for our clients. This investment strategy is a well-established, robust, proven, and repeatable process. We’re confident this approach will continue to succeed, as it has already proven effective in various market conditions to date. We are style agnostic, our overweight or underweight positions being driven by the output from our investment process, not some predetermined bias towards one factor or another.

Pearse MacManus, Chief Investment Officer, CFAM, explains the significance of our three-pillar investment process; “The robustness of our three-pillar process has been pivotal to our decades-long success, consistently driving long-term outperformance for our clients. As genuinely active managers, to be able to rely on our proven investment process through very different market conditions gives us confidence in our approach.”

Pearse also emphasises the importance of a flexible investment approach in rapidly evolving market environments. He notes, “There here have been many significant events impacting markets over the past 30 years. While we do not claim to get every decision right over all time periods, the combination of our investment process and being fleet-footed in the active management of our funds, has meant that we have delivered outstanding returns for our clients over all the key time periods.”

Investment Performance

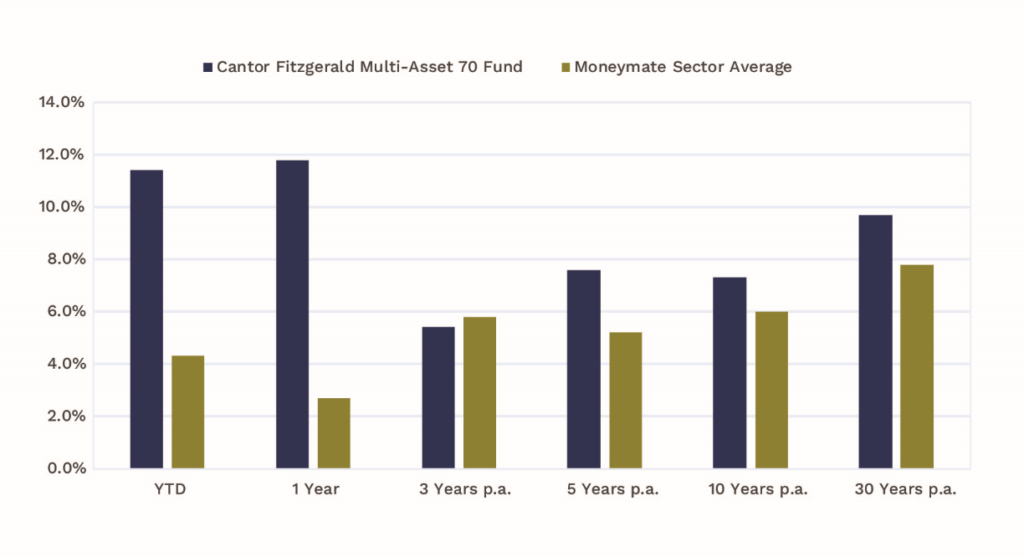

CFAM has a track record of providing excellent long-term returns for our clients across all our funds. In light of our 70 Fund’s 30th anniversary, the table below demonstrates the outperformance our investment team has achieved for our clients.

Source: MoneyMate & CFAM as at 31.10.2023. Fund performance figures are quoted gross of all management fees.

Kevin O Kelly, Head of Sales and Marketing, CFAM, discusses the impressive performance of the Multi-Asset 70 Fund. “The table above compares the investment returns of our 70 Fund to its benchmark, which is based on the MoneyMate survey of all similar funds in its risk category within the Irish market, over various periods. You’ll notice our fund’s significant outperformance, both short-term and long-term, compared to our peers. This success is a clear testament to the hard work and expertise of our investment team.”

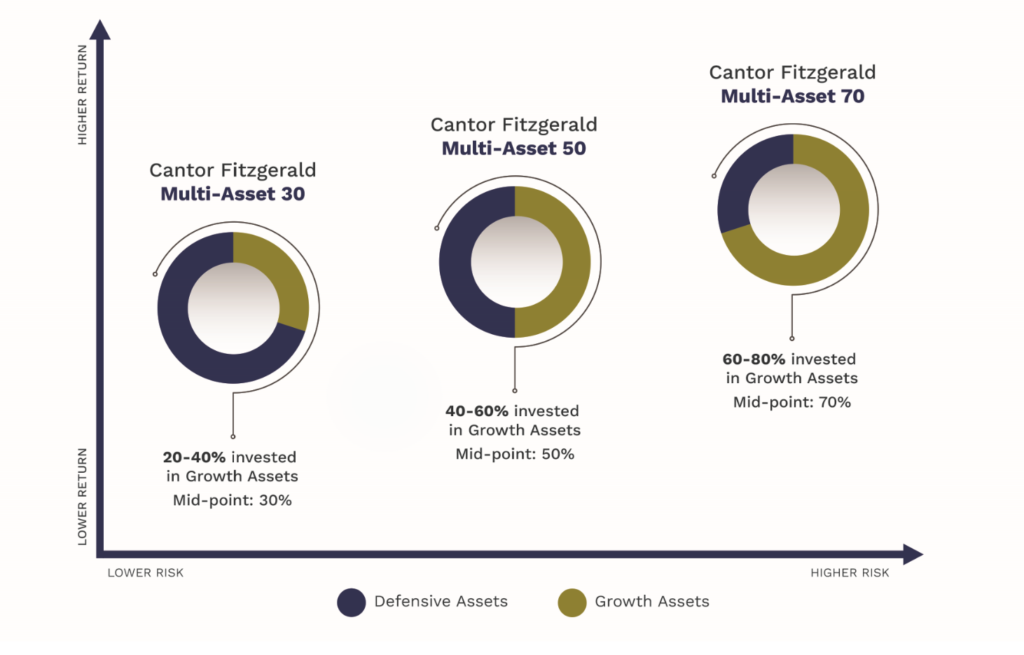

While CFAM’s celebration of its 30-year anniversary focuses on the 70 Fund, the company also successfully manages two other high-quality multi-asset funds. These are the Multi-Asset 50 Fund and the Multi-Asset 30 Fund. Though these funds are designed to be lower risk compared to the 70 Fund, they adhere to the same strategic investment decision-making process.

The graphic above illustrates the differences between the three funds. As exposure to growth assets reduces, the risk profile of each fund decreases. For example, the lower-risk 30 fund has a neutral position of 30% invested in growth assets, with a maximum exposure of 40%, while the 50 fund has a neutral position of 50% invested in growth assets, with a maximum exposure of 60%, and so on.

This flexibility allows advisors and their clients to select the fund that best suits each individual’s needs. The funds are priced daily and are fully liquid. Northern Trust acts as the custodian for these funds.

Please note that all three multi-asset funds are available through the Aviva platform.

1 Source: Based on the MoneyMate/Longboat Analytics pooled fund average Benchmark (Managed Aggressive >65% Equity)